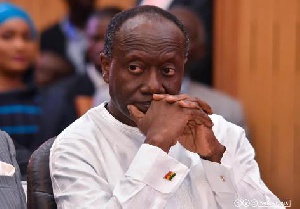

Finance Minister Ken Ofori-Atta has said the energy bond that was issued in October this year was the highest in West Africa.

As indicated in the Mid-Year Fiscal Policy Review, Mr Ofori-Atta said government planned to restructure the debt of the energy sector SOEs by leveraging the Energy Debt Recovery Levy component of the ESLA.

As a result, the Ministry of Finance this year sponsored the establishment of the E.S.L.A. Plc as a Special Purpose Vehicle (SPV).

The SPV established a bond programme to issue Cedi-denominated medium-to-long-term amortising bonds on the back of ESLA receivables to repay legacy debt to the tune of up to GH¢10,000.00 million, he said, adding: “The first tranche of bonds issued under this programme, comprised a 7-year (GH¢2,408.60 million) and a 10-year (GH¢2,375.35 million) bond with coupons of 19.0 percent and 19.5 percent respectively, for a total of GH¢4,783.97 million.”

“The proceeds from the bond issuance has helped reduce Non-Performing Loans within the banking sector and strengthened the balance sheets of the SOEs in the energy sector. To date the stock of energy sector debt has been almost halved. E.S.L.A Plc will continue to issue bonds to completely pay off the legacy debts,” Mr Ofor-Atta noted when he presented the 2018 budget to parliament on Wednesday, 15 November.

“Ghana's energy bond is the highest in West Africa and accrued GH¢4.7 billion.”

This comment comes on the heels of claims by the Minority in Parliament that the bond issue was a failure.

A former Deputy Minister and Member of Parliament for Ejumako-Enyan-Essiam said at the Minority’s Roundtable on the 2018 budget held on Monday, 13 November that: “This monumental failure is a classic vote of no confidence in the economy and the economic management team led by the Vice-President of the Republic.”

General News of Wednesday, 15 November 2017

Source: classfmonline.com