The Minority in Parliament has said the economy is challenged because of the government’s haste in implementing its numerous electioneering promises.

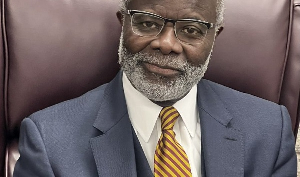

“The current crisis confronting the managers of the economy, compelling them to impose a raft of taxes on already burdened populace is self-imposed,” the Minority’s spokesperson on Finance Cassiel Ato Forson said Monday during a roundtable breakfast dialogue on the Minority caucus’ perspectives on the yet-to-be presented Mid-year Economic Performance and Projections of government by Finance Minister Ken Ofori Atta.

The fiscal problem, he continued “is the direct result of shallow opportunism and populism.”

“It is obvious that the promises made by the NPP in 2016 and their initial action as contained in the 2017 budget were intended only to get them elected and convey an impression fidelity to this crisis.

“The reality however, is that it has led to a major problem for the economy, translating into severe hardship for the generality of our people,” he added.

Mid-year

Ahead of the presentation of the mid-year budget review, the government of Ghana has already hinted of increasing taxes.

The government is considering introducing taxes such as;

1. An increase in Communications Service Tax from 6% to 12%?

2. A mandated minimum corporate tax

3. An expanded stabilisation tax? Collaterising royalties from minerals to enable government raise loans

4. Increased social security (SSNIT) contributions to the NHIS?

5. A Financial Service Tax

The government is also likely to increase the Value Added TaX (VAT) from 17.5% to 21% in the mid-year budget set to be presented to Parliament on Thursday, July 19, 2018.

The country’s Financial Management Administration Act requires the finance minister to come before Parliament not later than July 31, prepare and submit to parliament a Mid-Year Fiscal Policy review.

This often allows the finance minister the opportunity to review the targets, especially when it comes to the review, a. A brief overview of recent Macroeconomic Developments of Governments

1.Update of Macroeconomic forecast undertaken by the government

2. Analysis of total revenue and expenditure and performance for the first 6 months of this year

3. Also where necessary, revise the Medium Term Budget outlook the budget outlook and Expenditure framework