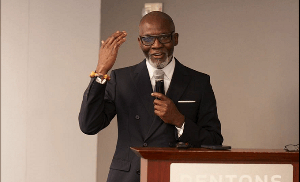

The spokesperson and economic adviser to the Vice President, Dr. Gideon Boako, has called on Bright Simons and Franklin Cudjoe to issue apologies for what he deems as their misleading comments regarding Vice President Bawumia's statements on the credit scoring system in Ghana.

During the 57th graduation ceremony at the Kwame Nkrumah University of Science and Technology last week, Vice President Bawumia praised the utility of the Ghana card in establishing a robust credit scoring system to uniquely identify borrowers. In response, Bright Simons, Vice President of IMANI Ghana, a Think Tank, questioned the accuracy of Bawumia's information, with further support from IMANI President Franklin Cudjoe. They referenced credit bureau company XDSDATA Ghana Limited, asserting that the agency already possessed the system described by the Vice President.

However, XDSData Ghana Limited clarified in a press release that it has not produced individual credit scores in the country. In light of this, Dr. Boako challenged Simons and Cudjoe to retract or apologize for their comments, emphasizing the importance of respecting other institutions' positions on matters of national interest.

While XDSData has the capability to generate individual credit scores, challenges arise from the lack of a unique identifier. Managing Director George K. Ahiafor disclosed that Ghana Card penetration currently stands at 35%, with expectations of reaching 90% by the end of 2024. This progress is crucial for XDSData to release individual credit scores, as facilities presently rely on various forms of identification, making accurate mapping challenging.

Mr. Ahiafor stressed that XDSData produces credit information comparable to international credit bureaus, providing valuable data for informed credit decisions. The mandatory use of the Ghana Card for financial transactions since July 1, 2022, has facilitated the submission of Ghana Card information to the bureau, but slow penetration remains a challenge.

Dr. Boako highlighted the importance of active support from the Bank of Ghana to ensure credit bureaus receive adequate Ghana Card data. Ghana aims to introduce a credit scoring system next year, with the Ghana Card serving as its anchor. Vice President Bawumia has initiated discussions with local automobile companies for citizens to purchase cars on credit, enhancing trust and discipline in the financial sector.

The announcement has sparked debate, with some claiming that individual credit scores are already in practice, prompting XDSData to clarify its position. In the realm of personal finance, a credit score holds significant power, influencing an individual's financial journey and eligibility for loans with favorable terms.

@lordcudjoe I see this as very unfair to @XdsData_Gh . You see, just like IMANI we should appreciate to respect other institutions and their positions on issues of national or public interest. Your comment in response to the statement they issued is way below your level and I…

— Gideon Boako, Ph. D (@gboakogh) December 6, 2023

Click here to follow the GhanaWeb General News WhatsApp channel

Watch the latest episode of Everyday People below:

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.