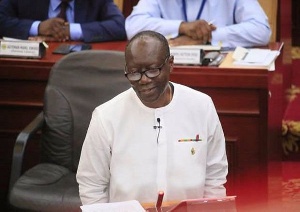

The expectations of Ghanaians with regard to the campaign promise by President Nana Addo Dankwa Akufo-Addo and the NPP to reduce the burden of taxes imposed on them by the previous Mahama-led NDC government was met yesterday after Finance Minister Ken Ofori-Atta presented the government’s maiden Budget Statement and Economic Policy.

The expectations of Ghanaians with regard to the campaign promise by President Nana Addo Dankwa Akufo-Addo and the NPP to reduce the burden of taxes imposed on them by the previous Mahama-led NDC government was met yesterday after Finance Minister Ken Ofori-Atta presented the government’s maiden Budget Statement and Economic Policy.

This was evidenced in the response of the people to the presentation, which triggered spontaneous jubilations among groups like spare part dealers at Abosai Okai and traders in general, as well as head porters, following the announcement of the abolishing of certain taxes previously imposed on them.

Prior to the 2016 elections, hundreds of traders across the country held series of conferences to register their protest against the ‘killer’ taxes imposed by the previous Mahama led NDC government.

The disgruntled traders were made up of members of the Ghana Union of Traders, Importers and Exporters Association of Ghana, Abossey Okai Spare Parts Dealers Association, Ghana Automobile Dealers Association, Ghana Institute of Freight Forwarders, and Customs Brokers Association of Ghana.

Finance Minister Ken Ofori Atta yesterday described the taxes as “nuisance” with low revenue yielding potential, “and at the same time impose significant burden on the private sector and on the average Ghanaian.”

He disclosed that the Nana Akufo-Addo government had decided to abolish these taxes to provide relief for businesses as part of its commitment to reenergize the private sector.

The taxes to be abolished include the 1 % Special Import Levy; the 17.5 % VAT/NHIL on financial services; the 17.5 % VAT/NHIL on selected imported medicines, that are not produced locally; the 17.5 % VAT/NHIL on domestic airline tickets; and the 5 % VAT/NHIL on Real Estate sales.

The list of reviewed taxes include a progressive reduction of corporate income tax from 25% to 20% in 2018; replacement of the 17.5% of VAT/NHIL with 3% flat rate for traders; and tax credits and other incentives for businesses that hire young graduates from tertiary institutions.

According to the finance minister, although the government is focused on reducing taxes to enhance production, it is determined to tackle the system abuse in the exemptions regime.

To this end, Mr Ofori Atta revealed that the review would cover, among others, the following exemptions and tax reliefs as a matter of urgency: “ import duties, taxes and levies payable by MDAs and other government departments; import duties and all forms of taxes and levies payable by both domestic and foreign companies, suppliers and contractors executing projects and contracts in the country; import duties and all forms of taxes and levies payable by employees, directors and senior officials of both domestic and foreign companies, suppliers and contractors executing projects in the country; import duties and all forms of taxes and levies payable by both domestic and foreign companies and investors doing business in the country; and import duties and all forms of taxes and levies payable by non-governmental and charity organizations.”

One District, One Factory

The finance minister observed that the implementation of the One District, One Factory policy which would commence this year would be closely intertwined with the government’s National Industrial Revitalization Programme.

“It is aimed at creating massive youth employment, especially in rural and peri-urban communities, add value to the natural resources of each district, ensure even and spatial spread of industries to stimulate economic activity in different parts of the country, enhance the production of local substitutes for imported goods, and promote exports and increase foreign exchange earnings,” he said.

He added that the policy has the potential of transforming the industrial landscape of Ghana, “and will contribute significantly to the socio-economic development agenda of the country, which is estimated to create over 350,000 direct and indirect jobs across the country.

National Identification Programme

Mr Ofori-Atta acknowledged that there was the need for a robust identification system, which would advance economic, civic and social activities in Ghana.

According to him, the benefits of having a modern, reliable and unique national identification system are enormous and imperative for the development of Ghana.

He promised that as part of the effort by the Akufo-Addo presidency to revive the NIA, the new leadership of the authority would be fully supported and resourced to be more effective.

He added that all registered persons would be provided with a Unique Identification Number, and an ID Card required for the provision and efficient delivery of public and private services.

Enforcement of the Public Procurement Act

According to the finance minister, the NPP government is going to strictly enforce the provisions of the Public Procurement Act.

He mentioned in particular the issue of sole sourcing, which had proven to pose significant risks to fiscal policy management.

He added that there would be the introduction of another level of approval for MD’S and MMDAs, explaining further that sole sourced procurements by MDAs and MMDAs beyond the threshold of GH?50 million will be subject to explicit approval by Cabinet before submission to the Public Procurement Authority for consideration and approval.

Poverty Eradication

In order to improve the state of basic infrastructure at the constituency level, especially in rural and deprived communities, the finance minister pointed out that the NPP government would undertake an inclusive development strategy.

“The Infrastructure for Poverty Eradication Programme will be our main vehicle for tackling these challenges. The IPEP is designed to direct our capital expenditure towards local, constituency-level specific infrastructure and economic development priorities, with particular emphasis on rural and deprived communities,” he said.

He disclosed further that every one of our 275 constituencies would be allocated the equivalent of US$1 million (GH¢4.39 million) annually.

Selected projects will fall into categories such as the One District One Factory; One Village One Dam; Small Business Development; Agricultural inputs, including equipment; “Water for All” Projects; and Sanitation Projects.

Job creation

The finance Minister again assured that the government would create an enabling environment to build the capacity of our youth, “to take on more active roles in our country’s future and its development.”

This, he said, had been reflected in key policy initiatives such as tax policy measures, Financial sector initiatives, Entrepreneurship development, One district one factory , One village one dam, small Business Development, stimulus package for industries, planting for food and jobs and Sanitation.

General News of Friday, 3 March 2017

Source: thestatesmanonline