Private Legal Practitioner, Maurice Ampaw is questioning why founder of the International Central Gospel Church (ICGC), Dr Mensa Otabil and the likes of William Ato Essien are walking free with their properties intact when they allegedly played roles in the collapsed banks.

On Kumasi Fm monitored by MyNewsGh.com, he proposed that their properties should also be confiscated and be arrested just like Nana Appiah Mensah alias NAM 1 if government wants to be fair.

He is accusing President Nana Addo Dankwa Akufo-Addo of reneging on his promise of dealing with persons who masterminded the collapse of indigenous banks.

“There was a bank fraud in this country and President Nana Addo told us that the persons involved will be dealt with…he told us persons found culpable will be prosecuted. Bank of Ghana Governor also told us that they will deal with them up till now Mensa Otabil, Ato Essien and others are walking free”, he revealed.

According to him, embattled Chief Executive Officer (CEO) who went to take money from Dubai is the one they are troubling when people used alleged dubious acquire new banking license are left off the hook.

“Is it because the Finance Minister is a member of Otabil Church is that why they have been silent about it”, he asked.

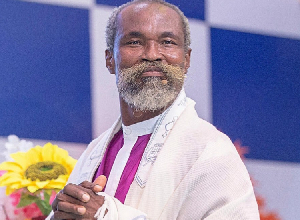

Dr Mensa Otabil, in a statement last year, said he was worried over the number of jobs that have been lost following the collapse of Capital which he served as Board Chairman.

The Man of God also revealed that he is cooperating with the appropriate agencies in unraveling the cause of the collapse of the indigenous Ghanaian bank said his primary concern is workers who lost their jobs which have adversely affected them.

A number of former staff of the banks including frontline managers have resorted to menial jobs for survival after their failure to land on new jobs more than a year after the takeover by GCB Bank Limited.

General News of Friday, 26 July 2019

Source: mynewsgh.com