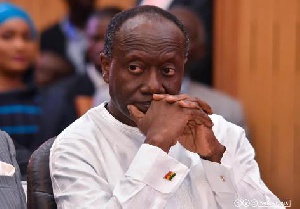

Finance Minister, Ken Ofori-Atta, has assured Ghanaians that the newly-established Consolidated Bank will be a more robust and better-managed bank, which will ensure strong indigenous Ghanaian presence in the banking sector.

The Bank of Ghana (BoG) on Wednesday, 1 August merged five struggling local banks to form The Consolidated Bank Ghana Limited.

They are The Royal Bank, The BIEGE bank, Sovereign Bank, The Construction Bank and uniBank.

According to the BoG, The BEIGE, Sovereign and the Construction banks obtained their banking licences under false pretences through the use of suspicious and non-existent capital, whereas The Royal Bank had non-performing loans which constitute 78.9 per cent of loans and uniBank had a capital deficit of GHS7.4 billion compared to the regulatory minimum of GHS400 million.

Mr Ofori-Atta, in a statement said: “The Government has taken note of the measures announced by the Bank of Ghana on 1 August 2018, to consolidate five banks (Beige, Construction, Royal, Sovereign and unibank) as part of efforts to restore confidence and trust in our banking system, and to protect depositors and jobs. Consistent with its commitment to upholding the operational autonomy of the Bank of Ghana, the Government supports these efforts to strengthen and clean up the banking sector.

“These measures, coupled with our commitment to fiscal consolidation and macroeconomic stability, should help improve the availability of credit to the private sector and reduce lending rates. Restoring trust and confidence in the banking sector by the Bank of Ghana is key to supporting Government’s efforts to transforming the economy.”

He added: “The Government is interested in ensuring that Ghana’s banking system is not only resilient and capable of driving the transformation agenda, but also supports the promotion and participation of strong indigenous Ghanaian banks. To this end, the government has incorporated a new bank called Consolidated Bank Ghana Limited [herein referred to as Consolidated Bank] and capitalised it with GH¢450 million. Consolidated Bank will assume selected assets and liabilities of these five banks whose licenses have been revoke by the Bank of Ghana.

“The Government has also provided financial support through the issuance of a bond in the amount of [GH¢5.76 billion] towards the Purchase and Assumption Agreement under which the Consolidated Bank Ghana Limited has acquired [all deposits and other specified liabilities, and good assets of the five banks]. This financial intervention will mitigate the impact of the consolidation of the five banks on the banking system and the wider economy and ensure that all customer deposits are protected. Moreover, the consolidation of the five banks achieves the twin objectives of promoting the safety, soundness, and stability of the financial system as well as strengthening Ghana’s indigenous banks.

“The new Consolidated Bank, which will initially be 100% government owned, will be a more robust and better-managed bank, which will ensure strong indigenous Ghanaian presence in the banking sector. To further strengthen the indigenous Ghanaian banking sub-sector, the Government is considering various structures through which it can provide financial support to help other indigenous banks meet the new minimum capital requirement of GH¢400 million by 31st December 2018. This support will be limited to indigenous banks that are solvent, well governed and managed and in full compliance with the Bank of Ghana’s regulatory requirements.

“Additionally, the Government will continue to explore policy interventions to transform the entire financial services sector into a more resilient and dynamic industry in order to promote and establish Ghana as a regional Financial Services Centre. The Government of Ghana’s primary goals are: to protect customer deposits; protect jobs as much as possible; protect strong Ghanaian indigenous representation; protect the integrity of the banking sector; ensure strict adherence to good corporate governance and to minimize systemic risk.”