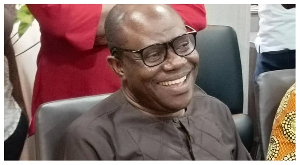

Economic and financial expert, Dr. Mahamudu Bawumia, has said the ruling National Democratic Congress (NDC) is ‘playing’ propaganda with the cedi and warned that such an attitude could be costly to the country.

“Rather than facing up to and dealing with this collapsed currency, the NDC propaganda in the villages is that Ghanaians should be happy because they are getting more cedis for the dollars and the pounds sterling their relatives send them from abroad,” the New Patriotic Party (NPP) vice presidential candidate for the 2016 election said in London at the weekend.

Addressing the Young Executive Forum-UK – a group associated with the NPP – on the state of Ghana’s economy, the former Deputy Governor of the Bank of Ghana said, “For the NDC, the management of the economy boils down to propaganda.”

“The government’s mismanagement of the economy has definitely been monumentally exposed by the cedi exchange rate. It is the one variable that cannot be manipulated in the long run,” he observed.

He analyzed, “Imagine that a worker earned GH¢1,000.00 at the beginning of 2009; this was worth some US$840. Today the same GH¢1,000.00 is worth some US$227.”

He said that in 2014, the cedi depreciated by 31% against the US dollar, making it one of the worst-performing currencies in Africa; and added that the depreciation of the cedi had continued in 2015, with 27% loss in value between December 2014 and June 2015.

Dr Bawumia posited that the cedi situation was notwithstanding the International Monetary Fund (IMF) bailout adding, “This reflects a lack of policy credibility on the part of the government and a lack of confidence by investors.”

In the last 18 months alone the cedi has depreciated by over 50%. “The periods of NDC economic governance have now become symptomatic with the periods of massive depreciation of the currency,” he noted.

Dr. Bawumia said that the massive depreciation of the exchange rate had been very costly for the economy – for businesses and individuals alike. “For any worker, the depreciation has been devastating for the cost of living as utility, petroleum and other prices of goods and services have shot up. The cost of doing business has also increased significantly,” he bemoaned.

He reiterated, “As I have said before, if you try to manage the economy with propaganda, the exchange rate will ultimately expose you.”

He noted that unfortunately, the government appeared ‘clueless’ as to what to do and added, “This is the price Ghanaians are paying for the government’s lack of policy credibility and weak fundamentals.

“Even the IMF bailout has not been able to restore confidence by convincing the markets that the government is committed to turning things around. The IMF itself has instituted a review of the government performance every four months.

“This is unprecedented for Ghana’s IMF programmes, and demonstrates a lack of confidence by the IMF itself in the government’s commitment to the programme, even though they would not publicly say so.”

According to Dr Bawumia, economic growth in the country was on a steep decline as records showed that real GDP growth had declined from 15% in 2011 with the onset of oil production, to a projected 3.5% in 2015, including oil; and the decline in economic growth, he maintained, is reflected across all sectors of the economy.

The economic expert said in 2015, interest payments alone on the country’s debt stock would amount to GH¢9.57 billion and that interest payments had increased from GH¢679 million in 2008 to a projected GH¢9.57 billion in 2015 which is an increase of 14-fold.

“Ghana’s total debt in 2008 was GH¢9.5 billion, but interest payments in 2015 alone would amount to GH¢9.5 billion. Interest payment as a percentage of GDP has also increased from 2.8% in 2008 to 7.1% in 2015.”

He continued, “In the energy sector for example, government is highly indebted to VRA and ECG. Government owes ECG some GH¢700 million and owes VRA GH¢1.0 billion. This has compromised the balance sheet of VRA and its ability to import crude oil for the generation of power.”

He said the situation had in turn forced VRA to over-use the Akosombo dam by 30% more than recommended since 2012, thereby causing the drop in the level of the dam.

Dr Bawumia stressed, “Ultimately, the dumsor problem is more of a financial problem than a technical one.”

General News of Thursday, 2 July 2015

Source: Daily Guide