The Media Foundation for West Africa (MFWA) is disputing some facts presented by Dr. Mahamudu Bawumia, vice presidential candidate of the New Patriotic Party (NPP) at his recent economic lecture dubbed: "The State of the Ghanaian Economy – A Foundation of Concrete or Straw".

According to the Foundation, the acclaimed economist and former deputy Bank of Ghana governor was untruthful in four out of the eight points presented at the lecture in Accra.

In a six-paged fact-check report released on Friday, Dr. Mahamudu Bawumia's claim that Ghana scored zero on the macro-economic convergence requirements (ECOWAS) were false according to the Media Foundation for West Africa.

Another claim by the respected economist that research allowance for lecturers has been cut; as well as claims of Youth unemployment are similarly untrue among others.

However, claims of a decline in agricultural output; Power plants operating below capacity; Real credit to the private sector recording negative growth in recent times and Ghana's decreasing creditworthiness among others are all true.

Read the full report below

Bawumia’s Lecture on Ghana Economy Fact-Checked: Only Four out of Eight Claims True

Dr. Mahamudu Bawumia made several claims whiles delivering a lecture on Ghana’s economy, eight of which were fact-checked. Out of these eight claims, only four were found to be either entirely true or mostly true. One claim was found to be a half-truth while 3 claims were found to be either completely false or mostly false. The full details of these claims and the basis for the fact-checking verdicts are presented below.

Claim 1: Our credit worthiness has been decreasing since we became an oil exporting company

Verdict: Mostly True

Explanation: A country’s credit worthiness refers to an assessment about the country’s ability to fulfil its financial obligations. This is normally referred to as a sovereign credit rating. Investors are informed by these ratings in decisions about whether or not to invest in a country, and at what returns.

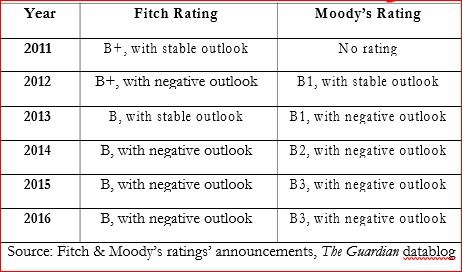

Credit rating agencies provide these ratings. Obtaining a good credit rating is usually crucial for developing countries as it tends to influence their ability to access funding in international bond markets. Since Ghana started importing oil in 2011, Fitch and Moody’s, the two most influential rating agencies have been regularly assessing and rating Ghana’s credit worthiness.

It can be seen from the table below that Ghana has slipped in Moody’s rating from a “B1 with a stable outlook” in 2012 to a “B3 with negative outlook” in 2016. To a lesser degree, Ghana’s credit worthiness has also dropped from “B+ with a stable outlook” in 2011 to “B with negative outlook” in 2016 on Fitch’s rating scale.

This gives some credence to Bawumia’s claim that Ghana’s credit worthiness has been decreasing. However, the country has over the years remained in the high credit or speculative risk rating category (B1, B2, B3) on Moody’s scale and (B+, B, B-) on Fitch’s scale. Also, Ghana’s credit ratings by the two agencies in the last two years has remained unchanged. These last two considerations informed the final verdict of “mostly true” on Dr. Bawumia’s claim that Ghana’s credit worthiness has been decreasing since we became an oil exporting country.

Claim 2: For the third successive year, Ghana scored zero on the macro-economic convergence requirements (ECOWAS)

Verdict: Mostly False

Explanation: The West African Monetary Zone (WAMZ) was established as the second monetary union in the West African sub-region with the aim of achieving a monetary union. The countries which make up the union include The Gambia, Ghana, Guinea, Liberia, Nigeria and Sierra Leone.

It is envisaged that the WAMZ will be merged with its francophone version, the West African Economic and Monetary Union (WAEMU), to form a unified monetary zone in West Africa. To accelerate the process of integration, some macroeconomic convergence criteria were agreed upon by the prospective member countries. The Zone has had to frequently postpone the launch of a single monetary and currency zone due to Member States’ inability to meet all the key macroeconomic convergence criteria simultaneously and on a sustainable basis.

It is on this basis that Bawumia claimed that for the third successive year leading to 2015, Ghana achieved none of the six major criteria. Evidence from Convergence Reports from the West African Monetary Institute (WAMI) negate this claim.

According to these reports, Ghana has not been performing well but the country was reported to have met two of the four primary macroeconomic convergence criteria in the first half of 2013 and 2015. On this evidence alone,

Bawumia’s claim is rendered “mostly false”.

Claim 3: Research allowance for lecturers has been cut

Verdict: Mostly False

Explanation: In 2014, government expressed its intention to review and replace the book and research allowance paid to teaching staff and senior members in public institutions of higher learning. Government planned to replace the allowance with a national research fund, to which interested persons could apply to for research funding. This policy intention was contained in the 2014 Budget Statement and Economic Policy (p. 190). Lecturers through organisations like the UTAG and POTAG had opposed the move, and even resorted to industrial action to drive home their demands.

The UTAG and POTAG supported the establishment of the proposed national research fund but insisted that the fund could co-exist with the Book and Research Allowance as these two interventions were not mutually exclusive. According to them, unsuccessful applicants to the fund within funding cycle could still be minimally supported by their book and research allowances.

Though the disagreement about the payment of the book and research allowance had often deteriorated into threats, counter threats, and strike actions, the government has continued to pay the allowance. The latest payment (GHc 37 million) for the 2015/2016 academic year was announced by Pres. Mahama and reported to have been received by UTAG in July, 2016. These evidences render Bawumia’s claim about the cutting of book and research allowances to lecturers, “mostly false”.

Claim 4: Inflation is currently at 16.7% which is the 8th highest in Africa

Verdict: Half True

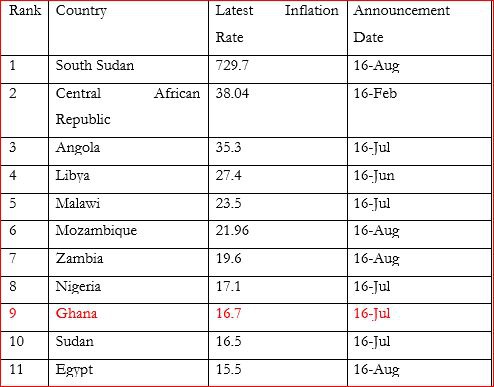

Explanation: An analysis of the latest inflation figures in Ghana and on the African continent as a whole indicate that Dr. Bawumia was accurate on the current inflation rate in Ghana (16.7%), but wrong about Ghana’s rank on the continent in terms of inflation rates. As can be seen from the table below, Ghana’s inflation rate is the 9th highest.

Claim 5: All our plants (power) operate below capacity

Verdict: Entirely True

Explanation: This claim was found to be entirely true. According to the 2016 Energy Outlook for Ghana report issued by the Ghana Energy Commission, none of the individual power plants was estimated to operate at its full capacity.

For instance, the Akosombo Hydro power plant though had an installed capacity of 1,020 MW, was estimated to have an average available capacity of 375 MW. Similarly, the Takoradi International Company (TICO) power plant had an installed capacity of 330 MW, but its estimated available capacity for 2016 was 320 MW.

Claim 6: Real credit to the private sector has recorded negative growth recently

Verdict: Entirely True

Explanation: Real credit to the private sector refers to the amount of domestic credit extended to the private sector relative to the gross domestic product (GDP) of a country. This measure is important because it is generally accepted to have a major influence on long-term economic growth and poverty reduction.

In other words, the more credit is available to the private sector in Ghana, the more likely it is that the sector will be able to expand and contribute positively to productivity, job creation, and overall improvement in the standards of living of Ghanaians.

Within this context, Bawumia’s claim of negative growth in real credit to the private sector was found to be entirely true. This is because the Bank of Ghana (BOG) in its Monetary Policy Report (p. 8) issued in May, 2016, acceded to this fact. According to the report, “in real terms, private sector credit declined by 6.7 percent, compared with a growth of 17.0 percent in March 2015.”

Claim 7: Agricultural output has also been on the decline

Verdict: Mostly True

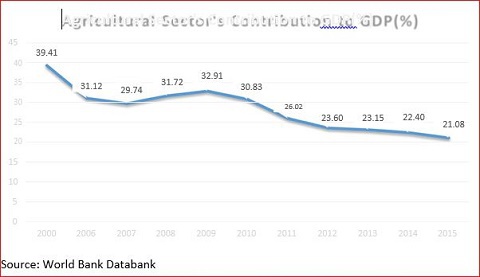

Explanation: According to MOFA, from a negative 1.7 percent in drought-hit 2007, agricultural growth recovered strongly to 7.4 percent in 2008, 7.2 percent in 2009 and then slowed to 5.3% in 2010. Growth again declined to 0.8 percent in 2011, and then stood at 1.3 percent in 2012. The annual budget reports also indicates that agricultural growth rose to 5.7% in 2013, dropped to 4.6% in 2014 and indeed 2015 recorded a decrease in growth to 2.4%.

Additionally, the agriculture sector’s contribution to GDP in Ghana has been steadily declining from 39.41% in 2000 and 32.91% in 2009 to 21.08% in 2015.

Looking at the growth trends of the agricultural sector and the sector’s contribution to the country’s overall GDP in recent years, it is fairly accurate to conclude that Ghana’s agricultural output has been declining.

Claim 8: The World Bank reports that youth unemployment is 48%.

Verdict: Completely False

Explanation: The 48% youth unemployment rate cited by Dr. Bawumia is, in fact, the proportion of youth within the 15-24 age bracket who were economically inactive. In fact, the 2016 World Bank report on youth employment in Ghana indicated that about a third (31%) of the 15-24 age group were economically inactive because they were in school.

Further, even though 14% of this age group were not working while also being out of school, only 4% of the 15-24 age group were considered unemployed by the report. The crux of the World Bank’s report is that youth who are out of school and economically active generally have access to jobs, but these jobs are of poor quality.

Also, according to the most recent Ghana Living Standards Survey (GLSS 6) report covering 2013, unemployment rate among the 15-24 age group was 10.9%.

General News of Friday, 16 September 2016

Source: www.ghanaweb.com