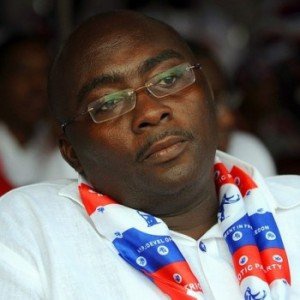

The words of Dr. Mahamudu Bawumia, Vice Presidential Candidate of the NPP in the 2012 elections has become prophetic again, as the renowned economist’s prediction on the economic woes of the country several months ago has finally been admitted by members of government and the economic management team.

In a series of statements and speeches he made, the former Deputy Governor of the Bank of Ghana foretold of the difficulties the country’s economy was going to face in the very near future as well as the resultant hardships to be experienced by the ordinary Ghanaian as a result of the mismanagement of the economy and unprecedented borrowing.

The last statement in which he foretold of the events we are seeing now was in February this year when he authored an article titled “THE ECONOMY IS ON AN UNSUSTAINABLE PATH WITH THE HIGHEST BUDGET DEFICIT IN GHANA’S HISTORY”.

The last paragraph in this article seems to have become very prophetic in the midst of the current hardships. Dr. Bawumia wrote

“Poor economic management has consequences. Unfortunately, the burden of the inevitable consequences of the NDC’s management of the economy is bound to fall disproportionately on the segments of society which are least able to afford it, as prices for petroleum products (whatever happened to the oil hedging policy?), transportation, water, electricity (in the face of water and power shortages), school fees, tax increases, expenditure cuts, unemployment, wage pressures, inflation, interest rates etc. Shoot up and non-oil GDP growth slows down. This reality is already being felt and will soon be patently obvious for all to see.”

This article released on February 18th was widely published in the media with various headlines as “Ghana’s Economy in danger, Dr. Bawumia Predicts Hard Times Ahead”, “Ghana’s Economy Heading into an Abyss”, “Economy on an unsustainable path with highest budget deficit”, “Government is running the economy down - Bawumia”, “Bawumia writes on Ghana’s Economy and Warns ‘Poor Economic Management Has Consequences’” among others.

As usual, this critique of the management of the economy was met with harsh criticisms from the government which touted so-called unprecedented achievements in the management of the economy and the unprecedented strength of the Ghanaian economy.

However, barely eight months on, the same government has had no option than to admit the crisis situation the country’s economy finds itself in with almost all statutory obligations in debt and a liquidity crunch which has affected such basics like payment of salaries and which has forced the government into a taxation spree, taxing or increasing taxes on almost all essential goods including mobile phones, cutlasses, condoms etc.

This same liquidity crunch has seen drastic hikes in utilities and fuel prices, making life unbearable for the ordinary Ghanaian as prices of all goods and services have seen significant increases in the past few weeks as a result of the hikes in utilities and the taxes.

But even before this last warning in February, Dr. Bawumia throughout 2012 warned the government on its path of economic management. One such event was the lecture given at the Ferdinand O. Ayim Memorial Lectures.

In that lecture given on 2nd May 2012, Dr. Bawumia cautioned the government to be prudent in its management of the economy and reverse its adverse policies, which according to him were going to lead to negative consequences for the health of the country’s economy.

On Page 20 of the 30-paged lectures for example, Dr. Bawumia noted:

“Mr. Chairman in the area of fiscal policy and public debt, the assessment of the prudence of fiscal management of our economy needs to be placed in context. First, it should be noted that Ghana’s GDP was retrospectively rebased from 2006. In simple terms, this resulted in a 60% increase in statistically recorded GDP from 2006. It should however be noted that the rebasing of Ghana’s GDP that has taken place is purely statistical. Statistically increasing Ghana’s GDP from 2006 by 60% was not accompanied by an increase in Ghana’s foreign exchange reserves or cash flows by 60%. That money was assumed to have been already reflecting in our cash flows prior to the rebasing. Nonetheless the rebasing makes our debt/GDP as well as our deficit/GDP numbers look better.

The rebasing of our GDP, along with the discovery of oil and increases in cocoa and gold prices have together relaxed the borrowing and foreign exchange constraints that have historically faced the Ghanaian economy. In this regard, policy makers if not cognizant or prudent can be tempted to increase government borrowing significantly without an accompanying increase in the liquidity and capacity to service such borrowing. Should this happen, as it appears to have, it will place pressures on the country’s foreign exchange reserves and would likely lead to a depreciation of the currency.”

General News of Friday, 11 October 2013

Source: The New Crusading Guide

Bawumia’s predictions come alive

Entertainment