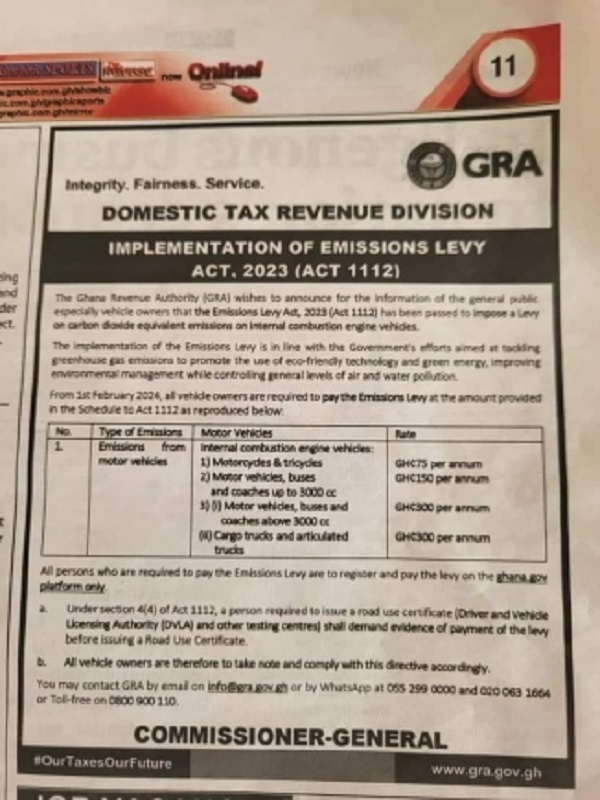

The Ghana Revenue Authority (GRA) announced February 1, 2024, as the start date of implementation of the Emissions Levy as passed by Parliament.

It turns out that implementation on Day 1 stalled because of a system malfunction, Accra-based TV3 has reported.

A report on their website read in part: "Checks by 3News indicate that the website through which applications were supposed to be processed (www.Ghana.gov) failed to function."

GhanaWeb Business has yet to get confirmation of the reported failure from our sources at GRA.

Per the law, persons seeking to pay the levy must process forms exclusively through the Ghana.gov platform before they can get to pay and be issued their road-worthy certificates at the Driver and Vehicle Licensing Authority (DVLA).

The tax measure, which was passed by parliament in December 2023, seeks to impose a levy on carbon dioxide equivalent emissions on internal combustion engine vehicles.

The levy forms part of government efforts aimed at tackling greenhouse gas emissions while promoting environmental and eco-friendly technologies to achieve net zero targets.

For instance, users of motorcycle and tricycles are required to pay GH¢75 per annum for the levy.

Motor vehicles, buses, and coaches which are up to 3000 cc will pay GH¢150 per annum, while motor vehicles, buses, and coaches above 3000 cc, cargo trucks, and articulated trucks will pay GH¢300 per annum.

See the list below as published by the GRA

• Motorcycles & tricycles - GH¢75 per annum

• Motor vehicles, buses and coaches up to 3000 cc - GH¢150 per annum

• (i) Motor vehicles, buses and coaches above 3000 cc - GH¢300 per annum

(ii) Cargo trucks and articulated trucks - GH¢300 per annum

SARA

General News of Friday, 2 February 2024

Source: www.ghanaweb.com