Following the 2024 general elections, President-elect, John Dramani Mahama, faces a formidable task of steering the country’s economy back to stability amid rising debt, inflation and energy sector challenges, analysts have said.

With the nation’s debt servicing obligations totaling approximately GH¢30 billion (US$2 billion) over the next four years, Mr. Mahama has pledged to take decisive action to restore fiscal balance and address the pressing concerns.

This comes as the government remains locked out of capital markets, complicating efforts to refinance its debt. The situation is exacerbated by soaring inflation, which has driven up the prices of essential staples.

Against this backdrop, Mr. Mahama has vowed to renegotiate Ghana’s deal with the International Monetary Fund (IMF) to secure more favourable terms.

The IMF programme, designed to stabilise the nation’s finances, has imposed strict conditions on government spending, which many argue have constrained economic growth and social programmes.

Lean government

Mr. Mahama has also committed to running a lean government as part of his strategy to restore investor confidence and ensure fiscal prudence.

This promise aligns with growing calls from economic experts for a reduction in government expenditure to free up resources for critical sectors like health, education, and infrastructure; an approach seen as essential for attracting much-needed foreign and domestic investments.

Ghana’s exclusion from global capital markets has left the country reliant on domestic revenue mobilsation; heavily focus on Treasury bills and taxes; and concessional loans to finance its budget.

Energy sector challenges

One of the most immediate challenges awaiting the incoming administration is resolving Ghana’s US$1.5 billion debt to independent power producers (IPPs).

Analysts warn that failure to address this could lead to plant shutdowns and a return of the dreaded “Dumsor” power outages that plagued the country a decade ago.

Mr. Mahama has acknowledged the critical importance of the energy sector to Ghana’s economic recovery.

He has noted the need for the government to work with the IPPs to find a sustainable solution to the debt crisis while ensuring reliable power supply for businesses and households.

Experts suggest that a comprehensive strategy involving sustainable payment schedules and increased investment in renewable energy could help stabilise the sector.

Inflation and currency stabilisation

Tackling inflation and stabilising the cedi will be another key priority for the new administration. The cedi has lost over 60 percent of its value against the dollar in three years, eroding purchasing power and increasing the cost of imports.

While the Bank of Ghana injected US$800 million into the forex market in November to stabilise the cedi, analysts caution that such interventions are unsustainable in the long-term. They argue that a focus on boosting local production and reducing import dependency will be critical to addressing the structural causes of inflation.

Mr. Mahama has emphasized the need for strategic reforms, by prioritising policies that stabilise the currency, reduce inflation and create an enabling environment for businesses to thrive.

Building public trust

Restoring public trust will be a critical test for Mr. Mahama’s administration. Ghanaians have grown increasingly frustrated with rising living costs and economic instability, which have fueled calls for urgent reforms.

Mr. Mahama has pledged to address these concerns head-on, promising a transparent and people-centered approach to governance.

As Mr. Mahama prepares to assume office, the challenges ahead are clear: managing debt, resolving energy sector liabilities, stabilising the currency, and rebuilding investor confidence. His ability to deliver on his promises will not only define his presidency but also positively impact Ghana’s economic trajectory for years to come.

Economic trajectory under Mahama and Akufo-Addo-Bawumia

Mahama’s tenure between 2012 and 2016 was marked by a mix of challenges and achievements, culminating in his electoral defeat in 2016. The Akufo-Addo administration, with Bawumia as Vice President and head of the Economic Management Team, promised a turnaround based on economic expertise but faced its own hurdles amid global shocks and internal fiscal pressures.

Inflation and monetary policy

Under Mahama, inflation steadily rose, with headline inflation increasing from 11.6 percent in 2011 to 15.4 percent by 2016, overshooting the government’s target of 10.1 percent.

In response, the Bank of Ghana’s Monetary Policy Committee (MPC) raised the Monetary Policy Rate (MPR) by 250 basis points, from 12.5 percent in December 2011 to 15 percent in December 2012. However, persistent inflationary pressures eroded purchasing power, contributing to voter discontent.

The Akufo-Addo-Bawumia administration saw inflation decline significantly, dropping from 15.4 percent in 2016 to 11.8 percent in 2017, reflecting tighter fiscal and monetary policies. Despite this progress, inflation surged in later years, peaking at 54.1 percent in December 2022 due to the COVID-19 pandemic and the Russia-Ukraine war, before easing to 20.4 percent in August 2024. However inflationary pressures have pick up again rising to 23 percent in November 2024.

Currency stability

The Mahama administration struggled with exchange rate volatility, as the Ghanaian cedi depreciated by 17.5 percent against the US dollar in 2012, compared to 4.97 percent in 2011. By 2016, cumulative depreciation stood at 9.6 percent against the US dollar, 5.3 percent against the euro, and 10.0 percent appreciation against the pound sterling. Specifically, the value of the cedi to the US greenback was GH¢4.30 to US$1.

These fluctuations reflected vulnerabilities in Ghana’s foreign exchange market.

Under Bawumia’s leadership, the Akufo-Addo administration initially stabilised the currency, aided by improved investor confidence and fiscal consolidation. However, the cedi faced renewed pressures in later years, driven by the weak fundamentals of the economy, exacerbated by external shocks, amid higher levels of public debt levels.

As of November 5, 2024, the cedi to the dollar rate stood at GH¢ 16.25 to US$1.

Debt and fiscal management

Mahama’s government presided over a sharp rise in public debt. Available data suggests that Ghana’s debt-to-GDP ratio had increased from 32 percent at the end of 2008 to 73 percent at the end of 2016. Nominal debt rose from GH¢9.7 billion to GH¢122.3 billion over this period, with interest payments consuming 45 percent of tax revenue in 2016. The fiscal deficit also widened to 8.7 percent of GDP on a cash basis, far exceeding IMF targets.

The Akufo-Addo-Bawumia government reduced the fiscal deficit from 9.3 percent of GDP in 2016 to 5.9 percent in 2017. However, the debt-to-GDP ratio continued to climb. Per the 2023 annual debt report, at end-December 2023, total central government debt provisionally stood at GH¢608.42 billion (US$52.23 billion), an increase from the GH¢447.78 billion (US$53.82 billion) recorded at end-December 2022, representing an increase of 35.9 percent.

Exchange rate depreciation alone accounted for 62.5 percent of the increase in the total public debt stock. The debt-to-GDP ratio was 72.3 percent at the end of 2023, marginally down from the 72.9 percent at end-December 2022.

In 2024, amid the ongoing debt restructuring, the public and publicly guaranteed debt value was reduced by GH¢46.8 billion from GH¢807.79 billion in September 2024 to GH¢761.01 billion in October 2024. The public debt to GDP ratio therefore reduced from 79.2 percent in September 2024 to 74.6 percent in October 2024.

Domestic Debt Exchange Programme and pensioners

The government’s Domestic Debt Exchange Programme (DDEP), launched in 2022, required restructuring GH¢137.3 billion worth of domestic bonds. While the programme excluded individual bondholders initially, it still affected numerous institutional investors, including pension funds, leading to public backlash. Many viewed the policy as a failure to safeguard citizens’ financial security, especially for vulnerable groups like pensioners.

Economic growth

Ghana’s economic growth under Mahama slowed, with real GDP growth estimated at 3.6 percent in 2016, below the revised target of 4.1 percent. In contrast, the Akufo-Addo-Bawumia administration oversaw a strong recovery, with GDP growth rising to 8.5 percent in 2017, driven by significant improvements in agriculture, industry, and services. Agriculture grew by 8.4 percent in 2017, up from 3.0 percent in 2016, while industry recorded 16.7 percent growth compared to a contraction of 0.5 percent the previous year.

Global shocks and policy responses

Both administrations grappled with external shocks that tested their economic strategies. Mahama’s government returned to the IMF in 2015, securing a US$940 million loan amid fiscal pressures. Similarly, the Akufo-Addo administration sought a US$3 billion IMF loan to address the economic fallout of COVID-19 and global supply chain disruptions.

The Akufo-Addo and Bawumia-led administration faced several controversies that also likely contributed to their defeat in the 2024 elections. These include the following key issues:

Galamsey (illegal mining)

The administration’s handling of galamsey (illegal mining) drew widespread criticism. Despite promises to curb this environmentally destructive activity, accusations of complicity and inaction plagued the government. Allegations arose that some government officials directly benefited from galamsey operations, undermining trust in the administration’s commitment to environmental protection.

E-Levy

The introduction of the Electronic Transfer Levy (E-Levy) in 2022, intended to address revenue shortfalls, was deeply unpopular. Critics argued it disproportionately affected low-income earners and small businesses, worsening economic hardships. Public outcry over the tax contributed to perceptions of poor governance.

NDC’s Parliamentary strategy and economic focus

The opposition National Democratic Congress (NDC) capitalised on the government’s economic mismanagement, making it a central theme in their campaign. By emphasizing the rising debt, high inflation and deteriorating public services under the NPP administration, the NDC resonated with voters. Their parliamentary efforts to challenge government policies further highlighted governance failures.

Scandals and governance concerns

Several high-profile scandals, including the Agyapa Royalties deal and issues of mismanagement in state enterprises, further eroded public confidence. The administration’s failure to address these scandals effectively, coupled with accusations of corruption and profligacy, left a negative impression on voters.

These factors collectively undermined the administration’s credibility and contributed to voter disillusionment, ultimately influencing the outcome of the 2024 elections.

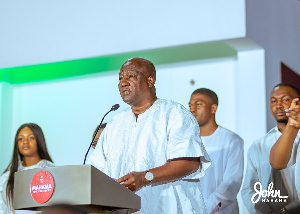

Watch highlights of Mahama's speech below

Click to view details

Business News of Tuesday, 10 December 2024

Source: thebftonline.com