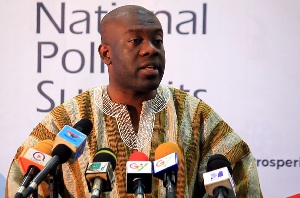

Information Minister-Designate, Kojo Oppong Nkrumah has described as absurd claims by a section of the public that president Nana Addo Dankwa Akufo-Addo is to blame for the collapse of about seven local banks in the country.

He argues that such claims lack merit and should be treated with the contempt it deserves explaining that those banks practically collapsed under the previous administration.

“The collapsed banks on paper had already folded up and were on emergency liquidity assistance. These banks were being given emergency liquidity assistance by the Central because they were found to be nonperforming”, he revealed on Accra-based Okay Fm MyNewsGh.com monitored.

According to him, what was happening then was for the Central Bank to pay salaries of those working in such banks when in the actual sense, these banks were not living up to expectation and should have folded up.

The Minister also stated that if the banks had folded up then, the situation of job losses would have been worse indicating that the takeover and merger has saved a number of jobs.

“Compensation will be paid to those who lost their jobs …..Severance packages for those who may not be retained. It is therefore not true Akufo-Addo is collapsing banks because these banks were just there and at the end of the month they go take money to pay salaries”, he revealed.

He cautioned the public against withdrawing cash to buy dollars urging them to have confidence in the banking sector are various measures are being put in place to strengthen the sector.

The Bank of Ghana in July this year, announced that it has revoked the licenses of five struggling banks and merged them into one it called Consolidated Bank Ghana limited.

They include uniBank, Sovereign Bank, Construction Bank, Royal Bank, and Beige Bank.

BoG said some of the insolvent banks obtained their licenses using suspicious and non-existent capital.

It added that some breached cash reserve requirement, others had negative capital adequacy ratio, and shareholders of some of the banks too engaged in supposed dubious transactions.

Prior to that, the BoG had earlier taken over uniBank with an excuse of saving the bank from collapsing.

It handed over the administration of uniBank to independent audit firm, KPMG Ghana after which it presented its report to the BoG.

General News of Monday, 17 September 2018

Source: mynewsgh.com