The Africa Center for Energy Policy (ACEP) has accused the Electricity Company of Ghana (ECG) of failing to meet core agreements with Independent Power Producers (IPPs), thereby affecting the Company's credibility in most Power Purchase Agreements (PPAs).

The Center accuses the country’s foremost power-distributing company of failing to raise capital in supporting these Agreements.

“ECG, therefore, needs to urgently put its house in order to assure the investor community that they are committed to fulfilling their financial obligations to IPPs,” a release from ACEP on Thursday advised.

The release was in connection with an agreement signed between ECG and Turkish firm Karadeniz Holding “to supply electricity to Ghana’s electricity grid through floating power stations”.

Though ACEP commended the agreement with the Turkish firm, it raised concerns over the credibility of ECG to sustain the deal.

Below is the full release:

The Africa Centre for Energy Policy (ACEP) is encouraged by the recent arrangement between Karadeniz Holding of Turkey and the Electricity Company of Ghana (ECG) to supply electricity to Ghana’s electricity grid through floating power stations.

This marks a major step in efforts to comprehensively deal with the short to medium term effects of the power crisis, which Ghanaians have endured since 2011.

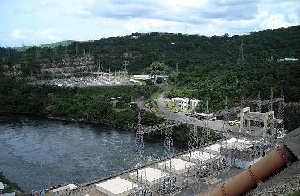

The Turkish company has agreed with ECG to supply 450mw of power to the grid annually for a 10 year period. Karadeniz Holding is a reputable power company in Turkey with a track record of supplying power through floating ships which berth on the shore.

The technology, floating power stations, has a reasonably short gestation period (conception to first power) and it is estimated that the company could supply power to Ghana early next year which deviates from conventional gestation periods of 3-4 years for onshore thermal powers systems.

ACEP’s policy recommendation throughout the crisis period has been a clear strategy to increase generation through investment attraction and institutional reforms that present the utilities as credible entities capable of meeting their commitments to investors and consumers. The arrangement with a Karadeniz Holding is a plus to investment attraction to the sector. What remains skeptical is the institutional capacity to make the arrangement sustainable.

Tariff setting is an issue that touches nerves in Ghana. The public confidence in the utilities to provide a stable supply of power with increased tariff has consistently waned on the back of failed promises. The challenge now is to show credible operational measures of improving on the distribution system which ensures that available power can reach the consumer. The reality is that floating power stations are a more expensive power generation option. It therefore requires higher and sustained tariffs sufficient to compensate for higher investment and operational costs.

ECG cannot also default in paying the generator from the floating power station, as has been the case with current generators. The credibility of ECG as the off-taker is fundamental to the sustainability of the mobile power system. The fact that the generator is floating on the sea means that if the investor is dissatisfied, the obvious option is to look for another market that is willing to meet financial demands of the generator. This could result in the ship moving to other countries that are willing to pay for power if ECG reneges on its financial commitment to the generator.

Power supply deficit in the Africa region alone stands at an estimated 100,000MW which could make floating power stations attractive to many other countries as a short term measure to provide needed power to cushion their demand.

ACEP urges ECG to make this new effort a reality, which would improve the power situation in a shorter time frame compared to other efforts in the pipeline. But again ECG should realize that its own credibility deficit explains why many Power Purchase Agreements (PPAs) never materialized. Many Independent Power Producers (IPPs) who signed agreements with ECG have not been able to justify the credibility of ECG as an off-taker to supporting raising capital. ECG therefore needs to urgently put its house in order to assure the investor community that they are committed to fulfilling their financial obligations to IPPs.

ACEP also wants to call for institutional coherence in addressing the energy challenges. Even though the Energy Commission is supposed to approve the Power Purchase Agreement, they are not aware of ECG’s arrangement with Karadeniz Holding. This is not the best way of handling a crisis of this nature and only highlights certain disjointedness in the institutional arrangement in Ghana.

General News of Thursday, 19 June 2014

Source: tv3network.com