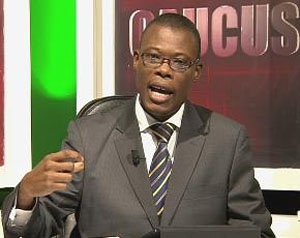

Minister of State at the presidency in charge of Finance and Allied Institutions, Fiifi Kwetey says contrary to Economist Dr Mahamudu Bawumia’s assertion that Ghana’s economy is not in a crisis, the current economic fundamentals are better than what the Kufuor administration left in 2008.

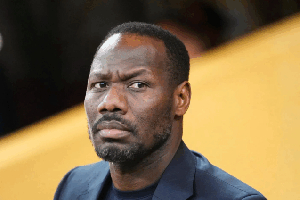

At a lecture on the depreciating value of the local currency against major global currencies of international trade at the Central University College organised in Accra on Tuesday, the former Deputy Governor of the Bank of Ghana said: “Government must admit that the economy is in a crisis so that it can carry the country along and get public support for the tough remedial measures it may have to take.”

He said: “The denial must therefore stop,” adding that: “The problem will not go away by refusing to acknowledge it.”

In an interview on Radio XYZ’s Strict Proof on Thursday, Mr Kwetey said: “Really if you want to look at the fundamentals of the economy, which is important, and compare the fundamentals as we have now to the fundamentals, as for example, we had at the end of 2008, the current fundamentals are far better.”

According to him, “now if Dr Bawumia who was part of the running of the system because he was then first Deputy Governor of the Bank of Ghana, if he, as part of that team, left behind fundamentals that were far far worse than what we have today and he’s describing today’s situation as crisis, then only God knows how he’ll describe what they left behind, maybe possibly super crisis.”

The former Deputy Finance Minister recalled that: “In 2008 at the time they were leaving, inflation was about 18 percent currently inflation is just in the region of about 14 percent, so talking about inflation we have not reached their leave. Cedi had depreciated in their time by about 20 percent in 2008 and pushed further for another 18 percent for the next six months. In all that’s about 38 percent. Possibly it would have been more if it were not that they had to sell Ghana Telecom. So if it’s simply the question of the fundamentals on those two levels, clearly they had a much worse situation.”

As far as deficits are concerned, Mr Kwetey said: “They targeted 4 percent ended up 15 percent nearly. That’s almost 11 percent going over the top. We for 2013 were targeting 9 percent. We got about 10.5 so let’s say we missed it by 1.5, they missed it by eleven and so if you are talking about comparison between what they left and we have, then theirs actually must have been the real crisis then.”

On the banking sector, Mr Kwetey said: “At the time they were leaving, non- performing loans in the banking sector had gone up to about as high as 21 percent. At the moment as we speak, it’s nothing near even 15 percent and so we don’t have a situation where a whole commercial bank like Ghana commercial Bank is on its knees because of huge TOR debt which was left in 2008. And so if you look at it in terms of comparison on one on one basis, the fundamentals today are stronger than the fundamentals then but that’s not to say we don’t have difficulties. That’s why I admitted from the beginning that we have challenges but our challenges nevertheless, the fundamentals of the economy are far stronger than what Bawumia and the NPP left behind at the end of 2008. That’s why you need to look at it in perspective.”

He said: “We are not running away from challenges, there are, and we say we would clearly be able to work and resolve them just as we have done in the past but the last group of people to want to talk about crisis is the NPP because the economy they left behind was an absolutely messy economy and they should not have even the moral authority to want to make a comment.”

By Dr Bawumia’s calculations, Ghana’s Ghc9.5 billion debt stock as of 2008, inflated to Ghc49.9 billion, representing an increase of over 40 billion in five years. He said the current debt stock represents 57.7 per cent of GDP, and predicted that: “Our debt stock will be 60 per cent to GDP ratio by the end of this year,” and warned that the country was gradually slumping into an abyss of unsustainable debt which could worsen the already aggravated situation since, according to him, unlike years past when the nation benefitted from the Highly Indebted Poor Countries (HIPC) initiative, such debt relief was no more available.

However, Mr Kwetey said: “Any time the economy faces challenges, you’ll have doomsayers who invariably will call it a crisis and you’ll have people who are far more realistic who will tell you the economy is having difficulties or facing challenges. And what it is that we have at the moment is not really too different from what the cedi faced in the first half of 2012 at the same time when people like Bawumia again came out basically screaming apocalypse and complete collapse of the economy and the crisis and all that and within a matter of months the government of the day was able to put policies in place the restored the strength and the health of the cedi again and so depending upon who is talking, doomsayers naturally will see crisis, far more realistic people will see difficulties and those difficulties are also opportunities because they represent challenges but they can be overcome and we are confident that we shall overcome them.”

General News of Friday, 28 March 2014

Source: xyz