First National Bank, one of the leading universal banks in Ghana, will be participating in discussions on enhancing local content for upstream petroleum at this year’s conference in Takoradi in the Western Region.

This event is themed "Sustaining local content development through enhanced exploration and production activities in the era of the energy transition". Hosted by the Petroleum Commission of Ghana, the event will promote talks on enhancing exploration and production activities as well as the development of marginal fields to sustain local content development, in preparation for the energy transition.

The Conference and Exhibition will provide a platform for stakeholders and players in the upstream oil and gas industry to deliberate on critical issues affecting the industry, explore investment opportunities, build business networks and deepen local content development.

Currently, over 300 indigenous companies have been registered under the local content policy and legislation, but less than 5% possess the financial wherewithal or have built the requisite capacity to contribute at least 5% capital and other technical requirements for exploration and production (E&P) which ranges between US$100-150 million.

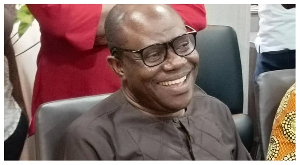

The Resources Portfolio Manager of First National Bank Corporate and Investment Banking division, Rexford Addi-Kissiedu affirmed that to improve the capacity situation, there is a need to get experienced infrastructure experts who will assist with project preparation, prioritization, and funding solutions.

“First National Bank’s corporate and investment portfolio for the energy sector has the capacity to support the upstream value chain activities in Ghana,” he stated.

This he mentioned is on account that the bank continues to offer funding solutions to a wide array of players in the infrastructure space from debt to equity.

“We are also able to play a financial advisory role in these projects which is evidenced by the recent Beitbridge border project in Zimbabwe where our team from the Rand Merchant Bank did not only act as a lead arranger but financial advisors as well.”

Mr. Addi-Kissiedu reiterated that capacity constraints on the government side can be remedied by skills sharing and more collaboration between the private and public sectors.

“If we are able to actively broker relationships with key players and formulate consortia that hold the skills to bid, we can definitely deliver exceptional financial solutions to support the sector. To move forward as a nation, we need to champion partnership and innovation,” he emphasized.

“We believe that partnership is the way to go. While there may be risks involved in infrastructure investment, and often a steep learning curve, the rewards for the country are exponential.”

First National Bank has also indicated the need for continuous investment in projects that have strong environmental, social, and governance considerations, especially in this era of the energy transition.

“Now more than ever, investments in the hydrocarbon sector need to be supported with environmentally friendly technology to enable Ghana and Africa to maximize value whilst we look to transition from fossil fuel usage to cleaner options of energy,” Mr. Addi-Kissiedu says.

Press Releases of Tuesday, 22 November 2022

Source: First National Bank