Founder of KAMA Group of Companies, Nana Dr. Michael Agyekum Addo, in March this year bemoaned how his finances took a nose dive after the financial sector clean-up exercise.

He said, "I am a pensioner and all my money, I must confess, the money that I saved to take care of my pension has been taken over by the banking clean-up."

Read the full story originally published on March 30, 2024 by www.ghanaweb.com.

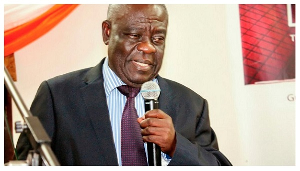

The CEO of Mikaddo Holdings and Founder of KAMA Group of Companies, Nana Dr. Michael Agyekum Addo, has shared a personal account of the financial challenges he has faced since the banking sector clean-up.

During a book launch at Academic City College in Accra on March 28, he revealed that as a pensioner, the savings he had accumulated over 30 years for his retirement were affected by the clean-up, leaving him unable to support initiatives he values, such as the book being launched.

"I am a pensioner and all my money, I must confess, the money that I saved to take care of my pension has been taken over by the banking clean-up.

"So, I don't have the money to support such a wonderful book. And if I tell you how much I saved for over 30 years to take care of my position now, you will weep for me,” he said.

Dr. Addo also mentioned the operational difficulties faced by one of his companies, which happens to be one of Tema's leading pharmaceutical manufacturers, due to the freeze on his funds.

According to him, the financial strain has led to issues with overhead costs, with pressures from tax authorities and utility companies exacerbating the situation.

"One of the best pharmaceutical manufacturing companies, WHO standard, in Tema; because my money has been locked up and they cannot give it to me, I'm having problems with my overheads. I'm telling you, either GRA is on your neck or the ECG has come to put off your light,” he shared.

His story sheds light on the broader impact of the banking sector clean-up on individuals and businesses across the country.

What happened?

In 2017, the Ghanaian government, led by the Minister of Finance, Ken Ofori-Atta, initiated a reform of the banking sector.

This overhaul resulted in the number of banks being reduced from 34 to 23. Additionally, 347 microfinance institutions, 15 savings and loans companies, and eight finance houses had their licenses revoked due to various corporate governance issues.

The cost of this intervention by the state, not including interest payments, was estimated at GH¢16.4 billion from 2017 to 2019.

However, the government later reported that the total expenditure on the banking sector clean-up reached approximately GH¢21 billion in 2020.

Several financial institutions that were affected by the license revocations have challenged the government's decision in court, and these legal proceedings are ongoing.

Watch the latest edition of BizTech below:

Click here to follow the GhanaWeb Business WhatsApp channel

Business News of Sunday, 3 November 2024

Source: www.ghanaweb.com