The Managing Director of FirstBanC financial services, Mr. Amenyo Setordzie has observed that although the wide-ranging tax cuts could place the government’s fiscal position under pressure, the 2017 budget is achievable.

Analyzing the 2017 budget presented by the Finance Minister last week, Mr. Setordzie described government’s finance policy as ambitious.

He however cautioned, “Key risks to the revenue projections include high inflation, exchange rate volatility and slow growth in lending, all of which will mitigate the positive effect of tax cuts on the business environment and affect revenues from income and property taxes as well as from goods and services.

“Furthermore, lower gold and cocoa prices resulting from higher US interest rates and weak global demand respectively, may dampen revenues from international trade.”

Below is his full statement

Executive Summary The Finance Minister read the Budget Statement and Economic Policy of the Government for the 2017 financial year before Parliament on March 2.

We discuss the key issues that are unique to this budget and those that will affect the capital market in particular. The budget aims at reducing the deficit and boosting growth, especially in the industrial sector.

The Finance Minister set out various policies that are intended to boost the Ministry’s ability to track and manage cash flows within the Government and the various MDAs, although it remains to be seen how effective these will be.

It also emphasizes key policy initiatives such as the National Identification Scheme, which we believe are necessary to formalizing the economy and broadening the tax base.

Several tax cuts to support private sector activity have been proposed and capital market initiatives that are likely to boost activity and liquidity are included in the document.

We consider the budget to be ambitious in its coverage, although the wide-ranging tax cuts stand to place the government’s fiscal position under pressure if expectations of increased business activity and private sector employment do not materialize.

Macroeconomic targets (%)

*estimate

The budget also targets, Primary surplus of 0.4% of GDP Current account deficit at 5.9% of GDP Gross Foreign Assets to provide minimum 3 months of import cover, same as in 2015 and 2016.

Growth in GDP for 2016 fell below target at 3.6%, largely due to challenges in oil production at the Jubilee fields which resulted from damages to the turret bearing on FPSO Kwame Nkrumah.

However, non-oil GDP growth was in line with projections at 4.6%. In 2017, GDP growth is expected to be driven by a sharp increase in oil production from the Jubilee and TEN fields as compared to 2016.

Production is estimated at 120,000bpd. In line with this expectation, the industrial sector is estimated to grow at 11.2% in 2017, ahead of Services and Agriculture at 5.1% and 3.5% respectively.

Revenue

Total Revenue is projected to be GH¢44.96bn (22.1% of GDP), up from GH¢33.7bn in 2016 (budget: GH¢37.9bn).

The chart below shows the government’s breakdown of revenues by sources. Domestic revenue is projected at 21.4% of GDP.

Key revenue items include GH¢13.4bn and GH¢13.9bn from income and property taxes, and taxes on goods and services respectively.

International trade taxes are expected to contribute GH¢7.1bn.

Source: Ministry of Finance

*This includes Energy Sector Levies in 2016 and 2017 In 2016, underperformance in income and property tax revenue (20% lower) contributed significantly to the revenue shortfall.

This underperformance was driven by lower-than-expected profit margins which resulted from high operational expenses, including utility costs.

Likewise, growth in private sector employment and expected salary increments did not materialize, affecting expected inflows from personal income taxes. International trade taxes were also 22% lower than projected due to the rising value of import duty exemptions.

Growth in revenue for 2017 will be supported by an increase in petroleum revenue from US$207.79m to US$515.64, as well as a 48% increase in income and property taxes from 2016 levels.

The projected petroleum revenue receipts are based on estimated production of an average 120,000bpd (2016: 103,000bpd) and a global Brent crude price of $56.14 per barrel.

Both estimates are reasonable, given that oil prices have traded in a tight $55-57 band since November 2016; in addition, the coming on-stream of the SankofaGyeNyame fields (estimated 30,000bpd) in August 2017, as well as ramped up production on the Jubilee and TEN fields imply that the budget estimate is achievable.

The sharp growth in international trade taxes is expected to be underpinned by savings of about GH¢1m resulting from the reduction of import duty tax exemptions.

However, the growth in income and property taxes is hinged on a rise in private sector employment and higher profits driven by the tax cuts in the budget.

Key risks to the revenue projections include high inflation, exchange rate volatility and slow growth in lending, all of which will mitigate the positive effect of tax cuts on the business environment and affect revenues from income and property taxes as well as from goods and services.

Furthermore, lower gold and cocoa prices resulting from higher US interest rates and weak global demand respectively, may dampen revenues from international trade.

Expenditure

Total expenditure is budgeted at GH¢58.14bn, an estimated 28.6% of GDP, compared to GH¢51.1bn in 2016. Below is the breakdown of projected spending, compared with actual figures for 2015 and 2016.

Out of this amount, compensation to public sector employees will account for the largest portion of GH¢16bn, whilst interest payments and grants to government units (including transfers to statutory funds) take up GH¢13.9bn and GH¢9.7bn respectively.

Source: Ministry of Finance

The projected expenditure includes GH¢3.74bn(2016: GH¢2.32bn) allocated for the payment of arrears and obligations from previous years (not shown in chart).

Interest payments are expected to increase to 24% of total expenditure, up from 21% in 2016 due to the increasing debt burden and the Cedi depreciation witnessed since December 2016.

We estimate interest payments on energy sector debts to be between GH¢800m and GH¢1.4bn for 2017, and the projected revenues from the ESLA will be sufficient to settle these payments.

In order to provide the fiscal space needed to pursue its policy objectives, the Government has proposed a cap on transfers to statutory funds and IGF retention to 25% of tax revenue.

This will put pressure on various government agencies including District Assemblies, which depend on Government transfers to carry out their mandates.

It also implies a shift from development led by the District Assemblies to one driven by the Central Government in pursuit of its policy initiatives such as the 1-district 1-factory programme.

The proportions of other expenditure components are fairly in line with actual 2016.

Key risks to expenditure overruns will include a higher-than projected spending on foreign debt interest payments as a result of weakness in the Ghana Cedi and accumulated arrears from previous years.

The 2017 budget maintains the current distribution of petroleum receipts, which was subject to review after the 3-year 2014-2016 cycle elapsed.

As a result, 49% of petroleum receipts (70% of amount given to Government) will be paid into the Annual Budget Funding Account (ABFA).

However, the Ministry proposed a change in the priority areas for spending of the ABFA during the 2017-2019 cycle from Expenditure & Amortisation of Loans for Oil and Gas Infrastructure Road Infrastructure Agriculture Modernisation and Capacity Building (Including Oil and Gas) to Agriculture,Physical Infrastructure and Service Delivery in Education, Physical Infrastructure and Service Delivery in Health, and Road, Rail and other critical Infrastructure Development.

The new priority areas are in line with the new Government’s key policy initiatives.

Fiscal Policy

The Budget indicated the Government’s decision to review the existing policy on Internally Generated Funds.

The Ministry of Finance will expand coverage of the e-monitor software and the gross lodgment policy on IGFs to additional MDAs, audit banking service arrangements with participating banks and transfer bank accounts of all government institutions to the Central Bank.

In addition, the Finance Ministry will assume a supervisory role over the National Pensions Regulatory Authority (NPRA) and wean it off government subvention, as well as enhance efficiency in the disposal of forfeited vehicles at the Customs Service by auctioning 70% of vehicles and allocating the rest to Public Servants at prices which include all eligible duties and taxes. The Ministry will also create a Treasury Management Unit in the Ministry of Finance to better manage the Government’s cash flows.

All of these will boost the Finance Ministry’s ability to track cash flows of the various MDAs and improve inflows into the Consolidated Fund, thereby opening up the fiscal space to enable the government pursue its policy initiatives. The Ministry of Finance also intends to establish a Fiscal Councilthrough an amendment of thePublic Financial Management Act, 2016.

The objective of the Council will be toensure the credibility of the Ministry’s fiscal projections, set up medium-term fiscal policy anchors to guide fiscal policy and monitor compliance of fiscal policy rules.

The work of the Council is therefore geared towards ensuring the realization of the Government’s fiscal targets in order to avoid the persistent slippages that have plagued Ghana’s fiscal policy in the past, although we are skeptical of its efficacy given 2016’s fiscal slippages under an IMF programme.

Policy Initiatives

The budget envisages the rollout of a national Identification programme which captures the biometric data of all Ghanaians and which will be essential for assessing public goods and services such as the National Health Insurance Scheme and bank lending, among others.

When completed, it will enable the government to streamline its service delivery to become more efficient.

It may also be the game-changer in the efforts at increasing the tax base, since this scheme will effectively bring the activities of some players within the informal economy under the scrutiny of the Central government.

Likewise, the addressing system for land and property will make government services more efficient; but perhaps more importantly, it will also enable the government better track property ownership and boost tax revenue through easy identification of individuals and institutions on whom the incidence of property taxes should fall.

The National Asset Protection Project is a programme designed to conduct a physical and financial audit to locate, identify and value uncompleted Government assets.

The programme will be managed by the Ghana Infrastructure Investment Fund (GIIF), after a review of the GIIF law to accommodate this purpose.

Key Interventions and Funding

As part of its policy programme for the nation and in fulfillment of some campaign promises, the Government has set out several interventions in the 2017 budget, including the Free SHS programme, the establishment of 216 medium to large scale factories across Ghana’s administrative districts, the Zongo Development Fund and the restoration of teacher and nurses trainee allowances.

In sum, this Government’s unique interventions and key policy initiatives will cost around GH¢2.1bn.

This amount will be financed by GH¢342m from the ABFA, GH¢785m from tax revenue and GH¢1.08bn that will be freed up from the realignment of statutory funds.

We note again, that any underperformance in personal and corporate tax receipts resulting from the weak economic environment will significantly impair the Government’s ability to finance these interventions.

In support of the cocoa sector, the Government intends to re-introduce compensation payments under the cocoa disease and pest control programme and introduce solar-powered pump irrigation on cocoa farms in the 2017/18 cocoa season

Tax Policy

The budget included a number of tax reliefs, several of which were previously defined as nuisance taxes in the run-up to the elections.

Among them are tax cuts on petroleum, electricity tariffs, imports of spare parts and a 3% flat tax rate to replace the 17.5% VAT/NHIL for traders.

The review of taxes on petroleum could help to lower prices at the pump, although this is unlikely given the recent depreciation of the local currency.

However, electricity tariffs will decline marginally following the reductions in the public lighting and national electrification levies.

The tax cuts to real estate sales and domestic airline tickets will provide a significant boost to those sectors, especially the local aviation industry, which saw decreased activity following the imposition of the taxes.

In order to address the persistent shortfalls in government revenue and to expand the tax base, the budget introduces the following revisions:

Introduce duties and taxes on imports by MDAs Remove NHIL tax exemptions on commercial loans Implement tax stamp on tobacco, cigarettes, alcoholic beverages and other tobacco products Review import duties and tax exemptions currently enjoyed by firms and officials executing contracts and projects in the country as well as non-governmental organizations Electronic Point-of-sale devices to enable real-time tracking of revenues by the GRA The review of these exemptions is expected to provide GH¢1bn in savings for the Government and offset any losses in tax revenue resulting from the proposed tax cuts.

We consider these actions to be a more concrete solution to replacing revenues lost from the tax cuts, as compared to the government’s expectation of a general improvement in consumer spending and business activity hinged on the tax cuts.

Capital Market Initiatives

The exemption of capital gains from taxes will be key to boosting interest in and attracting funds to the equity market.

With interest rates on government treasuries being at relatively lower levels, this exemption provides an added incentive for local fund managers and institutional investors, as well as foreign investors, to allocate more funds to Ghanaian equities, thereby helping to drive higher gains on the stock market.

Poor liquidity has been a key challenge of the stock market in the past, and any additional listings resulting from a sale of Government shares in SOEs or secondary listings by banks to meet the new minimum capital requirements will support the supply side of the market,and boost trading volumes and investor interest.

Furthermore, listed banks will likely generate higher returns and profitability through participation in large-ticket transactions and increased lending activity, thereby providing a further boost to stock market performance.

Banks will also have to deploy some of the fresh capital into safe assets, which will potentially drive demand for government treasuries and put further pressure on Treasury rates. A majority of the firms in the sectors mentioned (financial, telecommunications, mining) in the budget are profitable; listing them will provide the opportunity for Ghanaian investors to share in the profits these firms have accumulated and the huge potential that lies ahead.

Also, the effort to deepen the capital market by encouraging the development of REITs and MBS will provide more investment options, which is beneficial for all investors.

The decision to allow participation by pension funds will engender interest and liquidity within these new asset classes.

It will also allow investors to gain exposure to the earning potential of real estate investments in a less risky manner than would be possible in an outright purchase and/or development of property.

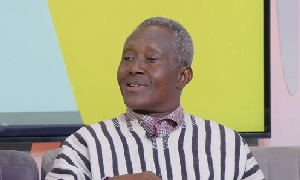

Managing Director, FirstBanC financial Services

Business News of Saturday, 11 March 2017

Source: 3news.com