The decision by the Takoradi Technical University (TTU) to invest a whopping GHS2.5 million in Brooks Financial Service, a private investment firm with the hope of making more profit is gradually becoming a mirage.

The huge investment is not only going bad but management has also come under severe criticism for taking the decision to invest the money without the knowledge and approval of the Governing Council.

A member of the Council told The Chronicle that members of the previous council were not aware when the decision was taken to invest the money in the financial company in 2016.

According to him, the present members were only called upon to ratify it, which was done against protestations from some of the members of the Governing Council.

The member, who did not want to be named, said the ratification was done after the issue was put into vote and the majority who were in favour won the day.

“Some of us voted against it because we could not condone the illegality that was being perpetuated by the Governing Council,” he said.

The Chronicle gathered from independent sources that the Economic and Organised Crime Office (EOCO) at a point in time came in and attempted to investigate the issue but the investigative body truncated the process after they were allegedly told by management that the Governing Council approved the investment.

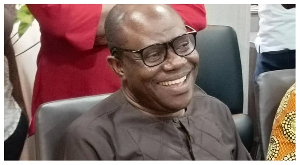

But the Vice-Chancellor, Professor Frank Eshun, told The Chronicle in the presence of other management staff that EOCO never made any attempt to investigate them and that the state investigative agency was rather assisting them to retrieve the money from Brooks Financial Service.

According to him, as spending officers, management members were clothed with powers to make such investments and that it is erroneous for someone to claim that they (management) failed to seek approval from the Governing Council.

According to him, the University management did due diligence to find out the financial standing of Brooks Financial Service including checking from the Security and Exchange Commission (SEC) which gave the investment firm a clean sheet.

He said the investment with Brooks was not the first or last investment the school would undertake.

He also showed this reporter documents that, according to him, proved that the Governing Council was in the known as far as the investment was concerned.

Notwithstanding this strong argument by management, the signs are clearly on the walls that the university may not get the money back.

The Chronicle gathered from sources in the university that though a court of competent jurisdiction has given orders for TTU to search, locate and garnishee the assets of the owner of the investment firm, Mr Ben Koudja, no positive results have been achieved.

Counsel for the University, Samuel Adinkra, who confirmed the orders of the court told The Chronicle that assets they located were later found to be in the name of different people.

Unconfirmed report indicates that EOCO had seized the passport of Mr Ben Koudja and digging deeper to lay hands on his assets, which they hope to sell to pay part of the money owed the university.

Though this alleged move by EOCO is yet to produce any positive result, Rev. Prof. John Frank Eshun, the VC, told this reporter that his outfit was hoping to receive the first tranche of payment from the investment company by the middle of this month.

Surrounded by the Financial Director, Emmanuel Boadi and a Lecturer, Asiedu Kokuro, the VC was optimistic that both the EOCO and BNI would help them retrieve the money and that the investment would not go waste.

General News of Wednesday, 8 May 2019

Source: thechronicle.com.gh