Ghana is not close to becoming a highly indebted poor country, a top official of Standard Chartered Bank has said.

According to Razia Khan, who is the Managing Director, Head, Africa Macro Research, Standard Chartered Bank, the economy of the West African country may be struggling, but key indicators show that Ghana has chalked a lot of successes in other areas.

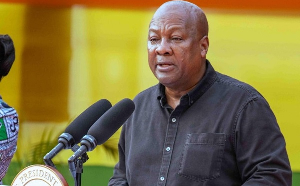

The John Mahama-led administration has gone for over $900 million bailout from the International Monetary Fund to salvage the ailing economy as the local currency continues to fall against major international currencies.

Khan has advised the government to maintain fiscal discipline in order to arrest the financial deficit the economy is going through.

Inspite of the challenges, she said the oil-producing country stands tall among her peers.

“For example, in the Millennium Development Goals (MDGs), Ghana has done far better than some of its peers and better results to show for some of the spending it embarked upon than other peers in the region,” the Stanchart boss said at the 2015 Standard Chartered Bank African Summit under the theme: “Africa is Rising”.

Khan, however, raised concerns about the rising debt and deficits in running the budget.

“These Treasury Bills have to be rolled over frequently and the kind of interests to be paid on such debts is even higher than the growth of Gross Domestic Product. If the interest rate you pay on your borrowing is higher than your GDP growth rate, then there is no way you can reduce deficit. The IMF deal gives Ghana the opportunity to make the difference,” she opined.

She noted: “Ghana is making progress, and is in the right direction but there is no easy way out for the country out of the fiscal challenges.”

General News of Friday, 1 May 2015

Source: starrfmonline.com