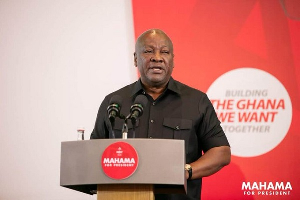

Ghana’s next president, John Dramani Mahama has a big problem.

As winner of Saturday’s election, he now has to pay some 30 billion cedis ($2 billion) of debt over the next four years. And he has to do that while the government remains locked out of capital markets.

The key to refinancing the burden will be to slow sky-high inflation in Africa’s biggest gold producer, and stabilize a currency that’s slumped more than 60% against the dollar in three years.

Rising prices of staples such as banku — a dough made of fermented corn and cassava — as well as plantains and onions have angered the nation of 33 million people, and most opinion polls showed that the opposition leader John Dramani Mahama will trounce the ruling party’s Mahamudu Bawumia.

It would be a Donald Trump-like return for Mahama, who lost the job in 2017, and perpetuate the cycle of revolving terms between the two main parties for the past three decades.

Bankers and fund managers we spoke to in Accra believe the next leader will need to curb consumer-price growth to less than 15% from 23% now. That may nudge the central bank to cut interest rates and open the local market for the new administration.

President Nana Akufo-Addo’s government has been selling short-term securities to fund itself after a restructuring of local-currency debt scared off investors.

His successor will also have to get more people to pay tax, cut wasteful expenditures — such as building a costly cathedral and buying new cars — and find new income sources to avoid seeking yet another bailout from the International Monetary Fund. It’s currently tied to a $3 billion package, the 17th since independence in 1957.

But first, the president will have to rein in prices of corn, rice, and bananas. Otherwise, his party’s fate may mirror his predecessor’s.

Click to view details

Business News of Tuesday, 10 December 2024

Source: bloomberg.com