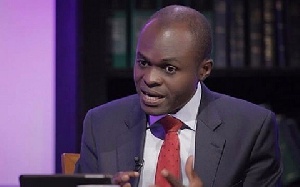

A private legal practitioner, Martin Kpebu, has asked the government to give tax incentives to some private companies to enable them absorb the 1,700 staff of the Consolidated Bank Ghana Limited (CBG) who are expected to be laid off.

According to him, this measure will help in reducing the effects of the of the retrenchment exercise.

Mr Kpebu, while speaking on TV3’s New Day Saturday September 1, 2018 said: “Let us make critical efforts at inviting companies to absorb some of these employees and then let us give them some tax incentives, this will help.”

Some 1,700 employees of CBD will, by the end of September 2018, lose their jobs.

Out of the number, 700 are mobile bankers of now-defunct BEIGE Bank, while 1,000 are former employees of The Royal Bank, The Construction Bank, uniBank and Sovereign Bank.

The Bank of Ghana recently fused uniBank together with Sovereign Bank, The Royal Bank, The Beige Bank and The Construction Bank to form a totally new local bank called Consolidated Bank Ghana Limited.

The fusion of the five banks follows the takeover of two other local banks: UT Bank and Capital Bank by GCB Bank in August 2017 with the blessing of the regulator after it emerged that they were in dire straits.

In total, seven local banks have gone under, as the Bank of Ghana’s 31 December 2018 deadline for all universal banks to recapitalise from the GHS120 million to GHS400 million draws closer.

General News of Saturday, 1 September 2018

Source: classfmonline.com