The Minority in Parliament has expressed concerns about the government’s tax exemptions to companies.

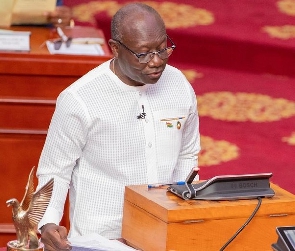

In a statement signed by the Minority Leader, Dr. Cassiel Ato Forson stated that in order to satisfy their insatiable greed, people who are used to living on the proceeds of corruption have turned their attention to tax revenue.

“We shall give support to these requests only on condition that any company that seeks tax waiver or exemption shall cede commensurate equity stake in their investment projects or business to the State in accordance with section 14(3) and section 15 of the Exemptions Act, 2022 (Act 1083),” Minority stated...

According to the Minority, the phenomenon of tax exemption as an avenue for corruption is a frightening development that threatens the domestic revenue reforms that the state is currently undertaking.

“As we speak, government is seeking to rake in some GHS11 billion from a plethora of new tax measures it has outlined in the 2024 budget. The effect of these new taxes will result in the poor becoming poorer, suffocating industries and businesses, and further increasing the hardships Ghanaians are already experiencing.

“This government is simply robbing Peter to pay Paul by exacting taxes from Ghanaians, only to dole out huge tax exemptions to their cronies for kickbacks. It is for this reason that we call on all Ghanaians to join us in this fight,” National Democratic Congress (NDC) lawmakers added.

General News of Monday, 27 November 2023

Source: starrfm.com.gh