Individual holders of the nation’s bonds have maintained their pushback against being roped into government’s proposed Domestic Debt Exchange Programme (DDEP), arguing among other things that it is punitive – and as such puts them at an undue disadvantage compared to institutional entities.

Government late in December last year announced an amendment to the initial Domestic Debt Exchange programme (DDEP), under which individual bondholders are being asked to submit to a “voluntary” exchange of their domestic bonds for new bonds. With the January 16 acceptance deadline looming, various groups have emerged with opposing sentiments.

The Individual Bondholders’ Forum (IBF), a voluntary group of individual bondholders, has raised concerns about the programme; claiming it irreversibly takes away the wealth and livelihoods of its members.

The group also accused government of showing total disregard for their contractual rights, as well as making no effort to structure reasonable consultation or dialogue with them.

“This is only possible because of the absence of effective representation and the perceived ease of oppressing a dispersed section of investors into submission,” it stated in a statement – calling the situation “deeply troubling and wholly untenable”.

It is of the view that the medium- to long-term prospects and outlook of the domestic investment culture in the country will suffer badly if the DDEP initiative is allowed.

“The medium- to long-term prospects and outlook of the domestic investment culture in Ghana is going to be affected by this DDEP initiative, and we call on government to demonstrate the needed sensitivity to enable a constructive resolution in the best interests of all,” the group said.

Consequently, the IBF has taken immediate steps in response to the DDEP, as it urges direct bondholders to reject and refrain from complying with the mandatory deadline.

The Group also encouraged indirect bondholders – such as investors in mutual funds, cash trusts and balanced funds – to inform their fund managers to reject the DDEP.

“The Domestic Debt Exchange Programme has been met with criticism and concern from various stakeholders in Ghana. This new development highlights the need for government and all stakeholders to engage in open and transparent dialogue in order to find a solution that will be beneficial for all. The Ghanaian economy is an important driver of the regional economy, hence any negative development in the country will have an impact on the region as well,” IBF added.

Pensioners

In a similar vein, another group – Pensioner Bondholders Forum – has petitioned government to exempt all pensioners holding sovereign Bonds from the DDEP; similarly to what was done for Pension Funds being regulated by the National Pensions Regulatory Authority.

The Forum, with a membership of over 200 pensioners and counting, strongly believes that the basis for exemption granted to pension funds holds good for exemption of the investments by pensioners in government bonds from the DDEP.

The basis for exemption of Pension Funds was to ensure that pension incomes to would-be retirees are not impaired for them to become a burden on others when on retirement.

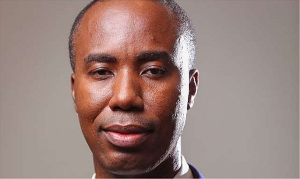

The Convener of the Pensioner Bondholders Forum, Dr. Adu Antwi – a former Director-General of the Securities and Exchange Commission (SEC) – passionately appealed for government to exclude all pensioner government bondholders from the DDEP, as the programme’s impact on pensioners who are bondholders will be very severe.

“We have no regular source of income to support us in terms of our feeding, buying regular medications, paying medical bills and meeting other critical expenses. Most of us have made investments in Government of Ghana securities with the expectation that the coupons will supplement the meagre pensions we receive through the Tier One Pensions Scheme under the Social Security and National Insurance Trust (SSNIT),” he explained.

Highlighting the reason for opting to invest in government bonds, the Convener added: “These government bonds are considered everywhere as gilt-edged and the safest securities to invest in; and as pensioners we had the greater motivation to invest in these securities for both safety and liquidity considerations.

“Our monthly pensions from SSNIT have been eroded by inflation – to the extent that these coupons have become our core income while waiting for payment of the principal amount upon maturity,” he added.

Government’s initial announcement of invitation to the DDEP on December 5, 2022 affected only institutional bondholders. However, this was later extended to individual bondholders in the final week of last month. The deadline is 4:00 pm (GMT) on January 16, 2023.

Given the Amended and Restated Exchange Memorandum terms of the DDEP is an extension of 15 years, the Convener noted that most of the pensioner – who are equally vulnerable in society – will not live long enough to receive their investments in these government securities.

Business News of Thursday, 12 January 2023

Source: thebftonline.com