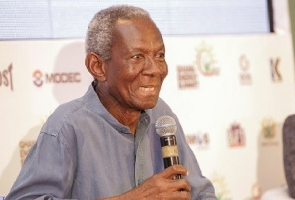

Renowned economist, Kwame Pianim, has expressed shock at government's decision to introduce three new revenue taxes amidst the current economic crisis.

According to him, he was taken aback after he was informed that government did not hold any stakeholder engagement with the business community on the passed 3 new revenue taxes.

Mr Pianim opined that government will be in trouble if it thinks it knows better than the citizenry.

Speaking on JoyNews’ Newsfile programme on Saturday, April 8, 2023, the renowned economist said, “I guess that if you are a government and you think that you know better than your citizen, then you are in trouble. You do not. And this is why I’m surprised, hearing from the AGI that there was no stakeholder consultation on these taxes."

“If you take the growth and the fiscal sustainability levy that the government is planning on bringing on, it is going to be paid into the Consolidated Fund and it’s for three years. It seems as if it’s just another lie to hoodwink the Ghanaian,” he added.

The business community including GUTA, AGI, GIFF among others have kicked against the 3 new taxes passed in parliament.

They explained that the move will gradually push them out of business as already, the cost of doing business in Ghana is high.

They called on President Nana Addo Dankwa Akufo-Addo to not accent the bill into law.

It would be recalled that parliament on Friday, March 31, 2023, passed three revenue bills, namely; Income Tax Amendment Bill, Excise Duty Amendment Bill, and Growth and Sustainability Amendment Bill.

The bills are expected to rake in GH¢3.96 billion for the country once implemented.

The Growth and Sustainability Levy is expected to raise approximately GH¢2.216 billion in 2023, while the Income Tax (Amendment) Bill, 2022 which amends the Income Tax Act, 2015 (Act 896) is expected to yield revenues of approximately GH¢1.29 billion.

The Excise Duty (Amendment) Bill, 2022 amends the Excise Duty Act, 2014 (Act 878) and is expected to yield approximately GH¢455 million.

But some Ghanaians, including the business community, have tongue-lashed Members of Parliament for passing the three revenue bills.

ESA/BB

General News of Monday, 10 April 2023

Source: www.ghanaweb.com