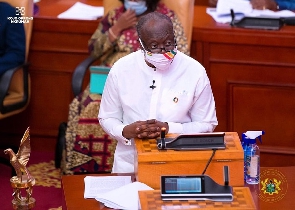

The Finance Minister, Ken Ofori-Atta has said the former president John Mahama has been dishonest with his criticism of the governing party’s handling of the banking sector clean-up.

The follows assertions made by Mr Mahama indicating that the Akufo-Addo government conspired with the Bank of Ghana (BoG) to cause the collapse of some banks and financial institutions.

The Finance Minister in an interview with Citi News at the 2020 launch of the NPP’s manifesto in Cape Coast called out the assertions as disingenuous for the former president to suggest that the clean-up exercise was not prudent and rather needless.

“I think it is kind of difficult and disingenuous for me when I hear that kind of talk and that is a former president so you need to give him proper respect and honour but we came and met an asset quality review which said these banks were bankrupt and it has been lying on their desks for over a year and the hard decision to take was not being taken,” Ofori-Atta explained.

He added, though the clean-up exercise was not a smooth one, it has yielded positive results with most depositors of collapsed banks and financial institutions having received back their locked up funds.

“No restructuring is perfect but must be done and I am unequivocal about that. At this juncture, the banks are stronger, they have been consolidated. Even those who were not strong enough but had the chance, we decided to give them money. 96 or 98 percent of the people have gotten their money.

“If you look at the resilience we have had currently and given the devastation of the pandemic in the world, there is no way Ghana will be where it is. I think it is quite easy to take one or two outliers and decry the policy but it took courage and real management of resources for us have to a strong financial institution,” he explained.

As part of its efforts to restore confidence in the banking and specialized deposit-taking sectors, the Bank of Ghana (BoG) embarked on a clean-up exercise in August 2017 to resolve insolvent financial institutions whose continued existence posed risks to the interest of depositors.

The clean-up saw the revocation of licenses of 9 universal banks, 347 microfinance companies, 39 micro credit companies or money lenders, 15 savings and loans companies, 8 finance house companies, and two non-bank financial institutions.

The move by the central bank was a comprehensive assessment of the savings and loans and finance house sub-sectors carried out by the BoG in the last few years after it identified serious breaches.

Click to view details

General News of Saturday, 22 August 2020

Source: www.ghanaweb.com

John Mahama dishonest in criticism of banking sector clean-up – Ofori-Atta

Opinions