The maiden Budget Statement of the Akufo-Addo government will be unveiled in Parliament today, March 2, 2017.

It will be the Minister of Finance Ken Ofori-Atta’s first major outing as he outlines government policies and strategies to salvage what his government has described as “the ailing economy” inherited from the Mahama administration.

President Akufo-Addo has served notice the budget has the magic wand to restore hope.

“We are going to fix it. We have outlined a number of prudent policies and measures which are contained in our first budget to be read on the 2nd of March,” Nana Addo told the Ghanaian community in Banjul on February 18, 2017.

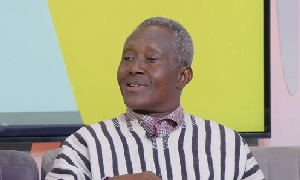

The government economic management team at work

These policy initiatives and measures, amongst others, the President noted will ensure that the private sector is strengthened and flourishes, adding that “it is only when the private sector flourishes that we can create the high numbers of jobs required by the teeming masses of Ghanaian youth. When the private sector flourishes, then we will be on the sure path towards progress and prosperity for all Ghanaians.”

It is for this reason that President Akufo-Addo reiterated his belief that his government will revive the Ghanaian economy, adding that “we are going to get our economy going again, and get enterprises in our country to be more competitive, so that they can begin to employ more and more people.”

Mr. Ofori-Atta had also hinted the budget is aimed at creating jobs as Ghanaians anxiously wait for some tax reforms.

According to the GN Research, “a major feature of this year’s budget will be its focal point on debt management and taxation reforms. This is because of the tight fiscal space which urgently needs expansion, so that the government can undertake expenditures that must be well – structured to grow the economy.”

“Also, GN Research expects major tax reforms in the budget, especially those taxes that hinder the growth of the private sector. In this regard, we expect the promise of reducing the corporate tax from 25% to 20% to be redeemed. We also expect the tax reforms to affect taxes on petroleum and other energy sector products. Aside these, we are likely to see some measures to expand the tax net. Every government in the past attempted to extend the tax net, yet they have failed largely.

“This is because of the challenges facing our identification systems and the failure to properly consider the extra revenues to be collected as against the cost of gathering them. Therefore, there is the need to see some innovative ways of widening the tax net to increase revenue generation. We likewise anticipate the tax reforms not to simply increase government tax incomes, but also serve to unleash the potentials of the individual sector,” GN Research said in a statement.

The Budget Statement delivery will be aired live on Starr 103.5FM and GHone TV at 10.30am.

General News of Thursday, 2 March 2017

Source: starrfmonline.com