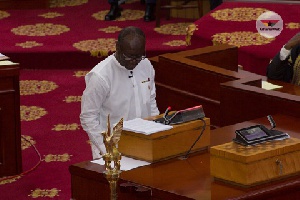

The Finance Committee of Parliament has summoned the Finance Minister Ken Ofori Atta to an emergency meeting Thursday.

The meeting is to probe further details and explanation for the controversial 3% flat rate tax that has been introduced by the government.

The 3% VAT rate came into effect on July 1, 2017 following the passage of Act 948 to amend the Value Added Tax Act, 2013 (Act 870).

The amendment gives legal backing to a new VAT Flat Rate Scheme (VFRS) of 3% that will facilitate collection of VAT & National Health Insurance Levy (NHIL) on the supply of goods by wholesalers and retailers; and classifies the supply of financial services, domestic air transportation and sale of immovable property by real estate developers as exempt supplies.

The implementation of the tax policy has triggered some deep seated controversy.

Some industries, manufacturers and importers claim the implementation of the new tax law will lead to the increase of prices of goods and services, a claim government and officials of the Ghana Revenue Authority have been quick to dispute.

Deputy Information Minister Kojo Oppong Nkrumah said the 3% flat rate is neither an additional tax nor a new tax.

He said it is only a new way of calculating the old value added tax.

“Traditionally to arrive at the value Added Tax you needed to calculate 17.5 on the cost of input, 17.5% on your final sales price, you will net off the difference and you will pay the net VAT to government.

"The challenge is that a lot of people find it difficult to comply with the paper work and the computations and so you will find a lot of evasions in the VAT bracket. It is for that reason that, not just in Ghana but in many other countries the VAT regime is gradually being moved to a flat rate.

Under this new policy you will just have to pay 3% on your turnover without the cumbersome calculations, he explained.

General News of Thursday, 6 July 2017

Source: www.ghanaweb.com