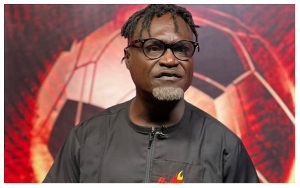

Dr Eric Oduro Osae, the Dean of ?Graduate Studies and Research at the ?Institute of local government studies, has advised local assemblies in the country to adopt modern technology to mobilize funds.

Advocating for the payment of rates to be “decentralized” through modern ways, he emphasized that such a move will get citizens to pay their taxes sanctioned by local authorities. The local governance expert was speaking on property rates the Morning Xpress on Radio XYZ Thursday morning when he made the call.

“If You don’t make it cumbersome and difficult for people to pay taxes. If you do that people may end up not paying taxes. They also need to strategize to ensure that they make the tax payment system so flexible,” he advised. To him the now dominating mobile money system can be adopted by the assemblies to mobilize fund.

“If I can pay by MTN money transfer or any other network and I can get my receipt and you give me an indication of how you are using my money, why won’t I pay?” he told Neil Armstrong-Mortagbe, the host of the programme. Reacting to why citizens feel reluctant to pay their property rates, Dr Oduro Osae urged local assemblies not to only educate citizens on the need for them to pay the rates, but also indicate to them how their monies are being used, stating that the extent to which the local government use the property rate is what will compel citizens to pay.

“How do we sensitize the citizens that they should pay and if they pay how do we connect these taxes to service delivery?” he quizzed. The local governance expert advised that the local assemblies render accounts on what the funds collected are used for.

“we have not as a country been able to explain to people the modalities of the processes that we go through even in determining the amount of property rate that people are supposed to pay,” he noted while advising the MMDAs to focus on how to increase revenue through the rates.

He said there are so many citizens who don’t know that their properties are supposed to be valued by a qualified valuer hence creating confusion among revenue collectors and property owners. To him some of the processes that should be adhered to in valuing a property are skipped, making it difficult to get people to pay the rate.

Education

He also indicated that one of the major hindrances to the payment of the rates is how the assemblies submit the details of what citizens should pay. Dr Osae also pointed out that if the local assemblies are able to carry out the required education on the need for citizens to pay such a rate, the Metropolitan, Municipal, and District Assemblies (MMDAs) can use it to generate more income especially the urban local government because of the value of properties in urban areas.

He also urged government to speed up processes to decentralize the operations of the Land Valuation Board to be able to support the local government to do the appropriate valuation for the assemblies to help them mobilize funds from the rates. The expert observed that citizens will be willing to pay their property rates if the processes used in mobilizing the funds are explicit and accounts rendered well.

Urging the local assemblies, he advised that they always do a cost benefit analysis if they wish to mobilize more funds for development. “The law allows you to even go to the bank and borrow money to do the valuation,” he said when asked of how expensive the process is.

He revealed that there is an ongoing project that will ensure that the Lands valuation division of the Lands Commission will decentralize their activities to support the local government to do property valuation of properties and engage revenue collectors to mobilize revenue for the assemblies so the assemblies should take pragmatic steps to get the needed funds to develop their areas than waiting for the District Assemblies Common Fund (DACF).

Politics of Friday, 11 May 2018

Source: myxyzonline.com