The embattled Chief Executive Officer (CEO) of defunct Menzgold Ghana Limited, Nana Appiah Mensah, popularly known as NAM1, and his two companies have been ordered to open their defenses to answer charges in the Menzgold case.

This was after the High Court in Accra dismissed his submission of no case to answer.

The Court ruled that the prosecution, through its nine witnesses, has been able to establish prima facie evidence against them in 35 out of the 39 counts.

Justice Ernest Owusu-Dapaa, while analyzing the 39 counts one after the other, found it a fact that the Court will need to hear from the accused.

Ruling on a submission of no case as to whether NAM1 has a case to answer, the Court said it appears that the accused (NAM1 & Brew Marketing Consult) did not possess a valid license to engage in the sale or purchase of gold.

Consequently, the Court said a prima facie case has been established against NAM1 and his companies to answer to the charge of selling gold without a license.

On the charge of operating a deposit-taking business without a license contrary to sections 6(1) and 22(1) of the Banks and Specialized Deposit-Taking Institutions Act, the Court said, "I find that it appears, at this stage of the prosecution, that Nana Appiah Mensah’s Brew Marketing Consult is UNKNOWN as an entity authorized to sell gold to the general public."

The Court ruled again that "NAM1 and Brew Marketing Consult must answer to the charge of 'Selling gold contrary to section 99(1) of the Minerals and Mining Act.'"

The Court also said evidence before the Court suggests that the Bank of Ghana did not endorse the deposit-taking business of NAM1 and Menzgold, and NAM1 will need to offer explanations to the Court.

On the charge of inducement to invest, the Court ruled that using 'beautiful' celebrities on billboards like Stone Bwoy, Becca, Joycelyn Dumas, and Jackie Appiah appears to influence the public to invest in Menzgold & Brew Marketing.

Justice Ernest Owusu Dapaa, while ordering NAM1 and his two companies to answer to 19 counts of defrauding by false pretenses, acquitted him on the remaining counts after the prosecution had abandoned three counts because of the unavailability of those victims.

The Court has also ordered the accused to open his defense to seven counts of fraudulent breach of trust after holding the view that the prosecution was able to establish a case against him and his companies to answer.

The Court also ordered that NAM1 open his defense to the seven counts of money laundering contrary to statute.

EIB Network’s Legal Affairs Correspondent, Murtala Inusah, reported that the effect of the ruling is that NAM1 and his companies are to answer two charges.

The case has been adjourned to July 23, 2024.

Background:

NAM1 pleaded not guilty to 39 counts of fresh charges and was granted GHC500k bail with four sureties without justification.

The bail terms also include an order for him to deposit his passport at the Registry of the Court and report to the CID headquarters every Thursday.

NAM1, who was also representing Menzgold Ghana Limited and Brew Marketing Consult, the other two accused persons, earlier said, "My Lord, I'm not guilty," as he responded to charges.

The 39 counts comprised a count each of selling gold contrary to section 99(1) of the Minerals and Mining Act, 2006 (Act 703), operating a deposit-taking business without a license contrary to sections 6(1) and 22(1) of the Banking and Specialized Deposit-Taking Institutions Act, 2016 (Act 930), and inducement to invest contrary to section 344 of the Companies Act, 2019 (Act 992).

The others include 22 counts of defrauding by false pretense contrary to Section 131(1) of the Criminal Offences Act, 1960 (Act 29), seven counts of fraudulent breach of trust contrary to Section 128 of the Criminal Offences Act, 1960 (Act 29), and seven counts of money laundering contrary to Section 1(2)(a)(i) of the Anti-Money Laundering Act, 2020 (Act 1044).

Click to view details

Crime & Punishment of Thursday, 11 July 2024

Source: kasapafmonline.com

Menzgold case: Court dismisses NAM1’s submission of no case, orders him to answer to charges

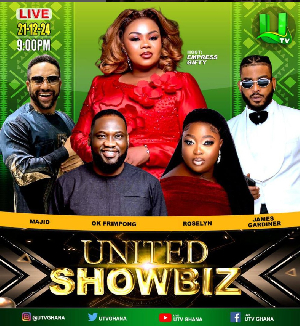

Entertainment