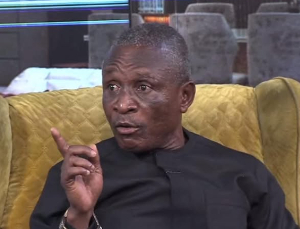

Accra, Feb. 28, GNA - Professor Mike Ocquaye, Minister of Energy has said that government cannot reduce the new prices of petroleum products because they were fixed to address various factors affecting the economy.

Reacting to a press conference held by the National Democratic Congress (NDC) and the subsequent announcement of an impending demonstration, the Professor mentioned the factors to include cost recovery, the need to build on the reserve stock and to ensure that the nation had enough price build-up to absorb any shocks resulting from further price increases on the world market. Government last week announced a 50 per cent increase in all petroleum products arguing that the new prices would enable it to remove the payment of subsidies, recover cost and channel resources from the sale of refined crude oil products to other sectors including education.

The NDC at a press conference said the government had no justification for increasing super petrol price from 20,000 cedis to 30,000 cedis per gallon. The party said it was not fair for the government to use the existence of a so-called subsidy to increase prices when it had the option to lower the various taxes, levies, duties and margins to keep fuel prices at reasonable limits.

In an interview with the GNA, Prof Ocquaye said other factors that informed the pricing of the commodity were the need to generate enough funds to pay the Tema Oil Refinery (TOR) debt and also continue with research into exploration opportunities in Ghana. Giving details on the factors, Professor Ocquaye said as at 2001, Ghana's petroleum debt stock was 3.4 trillion cedis but the amount moved to 4.5 trillion in 2002 from accrued interests. The nation is still servicing the debt and government needs funds to meet the responsibility.

The Minister could not give the amount paid so far, and what was left to be paid, but he said government would continue to use part of the new price to settle the rest of the debt. He said TOR and the Bulk Oil Storage and Transportation Company (BOST) needed enough funds to operate efficiently and all the required resources would come from the petroleum prices. Currently BOST is able to work to achieve two weeks of supply reserve but the nation needed at least six weeks of reserved fuel to be able to run efficiently without any shortages in the case of an emergency.

On the cushioning factor of the pricing mechanism Prof Oquaye said Ghana could not continue to be changing fuel prices as and when they moved up on the global market. The best solution is to have a price that can absorb and cushion the economy from any shocks that will result from world price hikes for a long period, he added. The previous price of 20,000 cedis was fixed to absorb shocks up to a world price hike of 45 dollars. The price of crude oil on the world market then was between 25 to 26 dollars but it currently the price hovers between 47 and 48 dollars.

However, Prof Ocquaye said he could not give an exact ceiling of prices of petroleum products that could absorb the shocks, as the situation was unpredictable. But he maintained that the 50 per cent increases could cushion the shocks from price hikes for a reasonable time. He also argued that government needed to have enough margins from the taxes on the petroleum products in order to deal with unforeseen and futuristic events. A research by the Chairman of the Petroleum Tender Board, Professor Addae Mensah and his team revealed that if the pricing of the product was left to the market forces, Ghanaians would have paid a maximum of 40,000 cedis as realistic prices.

Prof Ocquaye said throughout the world, governments got the bulk of revenues from petroleum taxes for road constructions, maintenance and other related works. He said if the NDC had the nation at heart, then they should offer constructive ideas rather than to throw dust into the eyes of the populace, saying, "if they had better ideas, then why is it that Ghana Commercial Bank nearly collapsed from their management." The basis for the NDC press conference was the gains that government would make from the various taxes built after the ex-pump price as given in the following from May 2003:

Ex-refinery price per litre of premium petrol was 2,251 cedis, while excise duty of 15 per cent Ad-Valorem was 337.75 cedis. Excise Duty Specific, 200 cedis; TOR Debt Recovery Fund Levy 640 cedis; Road Fund Levy was 400 cedis; Energy Fund Levy, five cedis; Exploration Levy was three cedis; Strategic Stock Levy was 30 cedis, Primary Distribution Margin, 44 cedis and BOST Margin 88 cedis. Ex-Depot Price was 3,999.44 cedis; UPPF margin was 130 cedis; Dealer's Margin was 110 cedis and Marketer's Margin was 205 cedis bringing the Max Indicative Ex-Pump Price to 4,444.44 cedis per litre. Compared to February 18 2005, the Ex-Refinery Price per litre was 3,032.26 cedis, while Excise Duty of 15 per cent Ad Valorem was 454.84 cedis.

Excise Duty Specific 200 cedis; TOR Debt Recovery Fund Levy was 640 cedis; Road Fund Levy was 600 cedis; Energy Fund Levy was five cedis; Exploration Levy was 10 cedis; Deregulatory Mitigating Levy, 442.58; Cross Subsidy Levy was 500 cedis; Primary Distribution Margin was 44 cedis and BOST Margin was 88 cedis. Ex-Depot Price was 6,016.66 cedis; UPPF Margin was 200 cedis; Dealer's Margin was 175 cedis and Marketer's Margin was 275 cedis bringing the Max Indicative Ex-Pump price to 6,666.66 per litre.

General News of Monday, 28 February 2005

Source: GNA