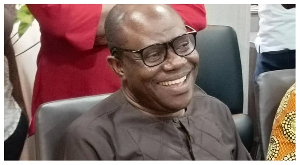

Accra, Sept. 28, GNA - Professor Yaw Adu-Gymafi, President of Ghana Medical Association, on Tuesday called for an innovative thinking into the new pension scheme that should consider among other components, remuneration, training, risk and stress in various professions.

Making his submission before the Presidential Commission on Pension at its second public sitting in Accra, the GMA President said these components should form part of the basis for arriving at the computation of the pension benefits.

He said at present it took about 12 to 16 years to qualify as a doctor and with the current difficult economic conditions doctors and other professionals needed decent pension benefits.

He said the allowances, (i.e. Additional Duty Hours Allowances) for medical practitioners should be consolidated into salaries in order to make the pension benefits more decent and attractive for practitioners. "Other than that we should look at the issue of allowances again." Prof. Adu-Gyamfi said the new pension scheme should be forward looking and one that would grow in order to make it more attractive and sustainable for the Ghanaian worker.

On the retirement age, he agreed with a member of the Commission that the 70 years limit for doctors should and be optional and rather put the mandatory age at 65 years.

Prof. Adu-Gyamfi said at the moment the country needed about 5,000 doctors "to begin to breath easily" because the 16,000 doctors to a population of about 20 million was low.

The Ghana National Association of Graduate Teachers (NAGRAT) advocated to the Commission a 10 per cent monthly employee's contribution pension scheme as against the current five per cent. Mr Kwami Alorvi, the Association's President, said the twelve-and-a-half per cent employers' contribution should also be increased to enable the over all benefit to go up.

He called for an amendment of the Cap 30 scheme that should take on board all workers of the Public Sector without exception. The Association, Mr Alorvi said, wished that the contributions already made to Social Security and National Insurance Trust (SSNIT) should be transferred to the Consolidated Fund.

"In addition, Government must strengthen its tax collection agencies and plug all loopholes in the tax collection system to ensure that revenue due to the state is not lost," he said.

NGRAT, he said was of the view that the current retirement age of 60 year's be maintained.

Mr Thomas Bediako, Chairman of the Commission, adjourned the sitting, which was supposed to end tomorrow Wednesday to Monday citing reasons that most of the bodies invited to make presentations had still not completed their recommendations.

The Commission is expected to begin similar sittings in the regions from next week.

General News of Tuesday, 28 September 2004

Source: GNA