AN ACCRA FAST Track High Court, presided over byJustice Victor Ofoe has adjourned to October 23, 2006, a case filed against Pharco Productions Limited, a moribund pharmaceutical company, by a shareholder, alleging manipulation of the company’s shareholding structure.

When the case was called last Wednesday, neither the plaintiff, Isaac Togbor Tetteh, nor his lawyer Adjei Lartey, was in court necessitating the adjournment.

However, a shareholder, Mr. Samuel Arthur Odoi-Sykes, who voluntarily applied to join the case was present, armed with documents to deflate the claims made by the plaintiff.

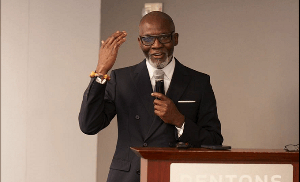

Mr. Tetteh, in his application, had alleged that for some unknown reasons, his shares in the moribund company had reduced to 520 from 526 shares, while those of Mr. Odoi-Sykes, Ghana’s immediate past High Commissioner to Canada, had galloped to 107,240 shares, from 2,190.

At the same time, plaintiff claimed that a certain Mr. Sadhwani, who had held 61 per cent shares in the company, suddenly also realised that his shares had plummeted. These, he argued were as result of manipulation of shares by some individuals in the company naming Mr. Odoi Sykes.

However, Mr. Odoi-Sykes who did not take the allegations kindly, voluntarily applied to the court to join as a co-defendant.

In his statement of defence, Mr. Odoi Sykes, who just returned from an ambassadorial posting said, Mr. Tetteh was not a serious person, describing him as a confused person.

According to him, he introduced Mr. Tetteh to the company where the plaintiff purchased 520 shares.

With documents to prove his case, Mr. Odoi-Sykes said, plaintiff was economical with the truth saying that, shares were floated upon a recommendation to the shareholders, by the Board of Directors of the company.

“New shares are first offered individually, by letter to all shareholders according to their percentage shareholding, for a specific period. At the close of the first offers, unpurchased or unsubscribed shares are then re-offered to other shareholders willing to invest more money in the company”, he stated. Mr. Odoi-Sykes explained that shareholders are duly notified, and comments are solicited in order to rectify any errors or anomalies.

He said with these fullproof mechanisms in place, Mr. Tetteh’s claims were not only distortion of facts, but were attempts to discredit the management of the company, and also attack his (Odoi- Sykes’) integrity.

“My shareholding in the respondent company, increased for over 30 years from 980 shares in 1975 to 91,052 in or about 2002, through purchases which I made on the floating of new shares on May 17, 1985, August 16, 1986, and the general allotment of bonus shares in or about 2002”, he said, in his defence.

Mr. Odoi Sykes pointed out that, the plaintiff had not been faithful to the court because contrary to his claim, that he held only 520 shares, he had bought additional shares in 1985 pushing his shares to 1146.

“From above explanations and statistical details of shareholdings in the respondent company, it is manifestly false for Mr. Tetteh to swear that his shareholding is recorded, or recognised as 520 shares.

“His paid-up shares since 1986, have been 6146 on which he has been paid dividends. And his last dividend was paid on 31,146 shares, but not on 520 shares”, he stressed. Supporting his submissions with evidence, Mr. Odoi-Sykes noted that Mr. Tetteh was overpaid last year, on shares he did no possess.

According to him, the plaintiff was paid ¢9,343,800 for the 2002 financial year, on shares of 31,146, when in actual fact, he did not hold such number of shares.

Mr. Odoi-Sykes said Mr. Tetteh’s paid-up shares were 6146 at that time.

“Mr. Tetteh is hereby challenged to demonstrate his good faith in his one-man campaign for probity and accountability in the company, by explaining when and how he acquired 31,146 shares in the company on which his dividend for 2002 was based.

The former envoy denied that Mr. Sadhwani held 61 per cent shares in the company.

“Mr. Tetteh’s affidavit that Arjandas Sadhwani once held 61 per cent of the shares in the company amounting to 45,750 shares is a complete falsehood, and betrayal of gross ignorance of the company’s affairs”.

He explained that, when he joined the company as General Manager in 1975, the total shareholding was 91,500, with Mr. Sadhwani, a British national and co-founder, holding 39.25 per cent, while two German nationals held 38.25 per cent, with the National Investment Bank (NIB) having 11.50 per cent stake. Six private individuals, together had 11 per cent.

However, the 1975 Acheampong’s nationalisation decree caught up with the company, reducing the stake of foreigners to 50 per cent, while the remaining 50 percent shares were sold to Ghanaians.

Mr. Odoi-Sykes said the company’s shares had never been manipulated, adding that the company’s operations had been prudently managed with the financial statements being examined and approved by the Board of Directors.

He said at all material time, Mr. Tetteh had joined in approving the financial statements at shareholders’ meetings.

“If Mr. Tetteh was truly aware, or concerned about any fraud and financial improprieties allegedly taking place in the company, then he was morally and legally precluded from endorsing and even personally supporting the approval and acceptance of the yearly audited accounts of the company, from 1996 to 2004” he stated.

The former envoy argued that Mr. Tetteh’s action was borne out of malice, because of his legitimate intervention to stop plaintiff from milking the company.

According to him, Pharco Productions has not been operational for the past 10 years, and that it survives on incomes from rent with a foreign diplomatic mission since 1993.

But Mr. Tetteh and another shareholder, Anthony Kodua had been drawing sitting allowances of ¢500,000 for every meeting in addition to directors’ fees and transport expenses, which Mr. Odoi-Sykes indicated were uncalled for.

“My intervention to stop Mr. Tetteh from milking the company is the only reason for his one-man campaign of vilification, and mudslinging against me. Before that incident, he had never complained about any financial improprieties or manipulation of shares, which he now wants to be investigated for the past 20 years” he stressed.

Mr. Odoi-Sykes stated that the allegations were concocted and intended to hurt his reputation and public image.

He therefore, pleaded with the court to throw away plaintiff’s application.

“Mr. Tetteh’s application should not be entertained, because it has been brought in utmost bad faith, without a genuine object of obtaining the reliefs asked for, but for the collateral purpose of scandalising me and damaging my good name and image. It is an abuse of the process of the court, which should not be encouraged”, hesubmitted.

General News of Wednesday, 19 July 2006

Source: Daily Guide