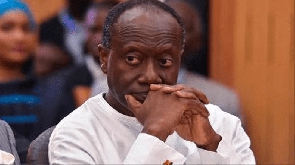

Data Bank, an investment firm which has Finance Minister Ken Ofori-Atta as co-owner has relinquished its role as financial advisor in the controversial Agyapa Deal.

Data Bank and Imara Holdings Limited were the two advisors for the deal which has currently been suspended and referred to Parliament.

CitiNewsroom reports that Data Bank had written to Imara Holdings over its decision to withdraw as financial advisor.

In the supposed letter, the management of Data Bank said that the decision was necessitated by the attacks on the person of Ken Ofori-Atta.

Despite the belief that their presence on the deal would have served the interest of Ghana, they believe that pulling out is a necessary step in protecting the reputation of Ofori-Atta and the bank itself.

“The Board of Directors of Databank has observed with deep concern persistent attempts by some political actors, during the political season leading up to the general elections of December 2020, to tarnish our hard-won reputation painstakingly built over the last 30 years, by unfairly exploiting our participation and involvement in the transaction as one of the transaction advisors. We believe this is principally due to the Minister of Finance’s association with Databank as its co-founder.”

“The Board of Databank, whilst being convinced about the immeasurable benefits to be reaped by the Republic of Ghana from the transaction, is of the view that the tumult generated by the involvement of Databank in the transaction, coupled with insinuations and aspersions cast on the reputation of the company in the lead up to the election, not only grossly compromises the ability to execute such a market-sensitive and novel transaction, but also has a real tendency to severely damage the invaluable business reputation of Databank,” the letter signed by Kojo Addae-Mensah, Group CEO of Databank explained.

“It is this deep market knowledge and extensive experience that makes us understand that the potential damage from the fall out of all the negative press regarding Databank’s involvement in the Agyapa transaction, especially the proposed IPO, despite our sterling track record over the years, is incalculable both in the domestic and international financial markets.”

“The reasons expressed above have compelled us to take the hard-decision to formally withdraw our services as your partner and co-transaction advisor on this mandate.”

The Agyapa deal formed part of government plans to ensure that the country extracts as much benefits as possible from its mineral resources.

It was going to be the monetization of Ghana’s gold royalties through the dual listing of the Agyapa Gold Royalties Company on the Ghana and London Stock Exchanges.

The deal, however, hit a snag following a damning report by the former Special Prosecutor, Martin Amidu.

Business News of Thursday, 11 February 2021

Source: www.ghanaweb.com