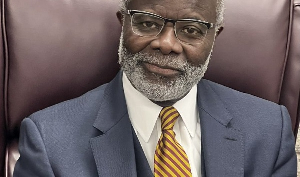

Accra, Jan. 31, GNA - Mr Yaw DiOwusu-Agyeman, Chief Executive Officer of the Capital Builders Network Limited (CBNet), on Monday maintained that the company is genuine and has done all the right things in the setting-up and operation of its 93Susu Nnoboa" system.

He said the company was neither 93a Pyram nor an R5" as claimed. Mr DiOwusu-Agyeman, who was addressing a press conference in Accra, said currently the accounts of the company had been frozen until investigations were over and appealed to its clients to exercise patience. He challenged persons who had proof of anything negative about the operations of CBNet to present such evidence to the appropriate authorities for action.

Mr DiOwusu-Agyeman explained that the management of the company was summoned before various committees at both the Bank of Ghana (BOG) and the Economic and Organised Crime Office (EOCO) to answer questions, present the its audited accounts within a three-day deadline and also present all necessary documentations regarding its registration, tax obligations and bank accounts which it had duly done.

"We are therefore surprised to hear on air that the BOG, even before concluding its investigations, has put out a damning notice about the Company cautioning Banks, Non-Bank Financial Institutions and the general public in their dealings with the CBNet", he said. "We are currently devastated by this position, but Management has no= t reacted to the directive to embarrass the BOG for stabbing us in the back because corporate Ghana is more important to us than our reputation", he said.

Mr DiOwusu-Agyeman explained that CBNet was a genuinely registered entity in Ghana which operated under a modernized 93Susu Nnoboa" system, which combined referral marketing and Information and Communication Technology (ICT) in capital mobilization for its participants. He said the system was to help individuals to build capital using thei= r own network of friends, relatives and close associates. It was also to regularise the 93SUSU" system by making it modern, transparent and credible, he said, adding that it worked with several banks where its clients were encouraged to operate savings accounts for the transfer of money.

Mr DiOwusu-Agyeman said the company currently had three networked offices in Accra and Tema and had grown from its initial clientele of about seven persons to over 11,000 members within a period of five-months. However, the Bank of Ghana has said its preliminary investigations undertaken into the operations of the company indicate that CBNet is involved in some form of deposit mobilization activity for which a licence has not been obtained from the Bank of Ghana. "Indeed, the operations are 93pyramid" or 93ponzi" schemes as the pay-off of earlier contributors depends on the continuation of a chain of subsequen= t joiners of the scheme", the Central Bank said in a statement issued by Mr Alex Bernasko, Secretary of the Bank.

The statement said: 93To safeguard the financial system, the Bank of Ghana is conducting further investigations into the background of the directors and the full activities of the company. "The public is hereby informed that the company has not been license= d by the Bank of Ghana. The Bank of Ghana is concerned about the possible losses that patrons can suffer and cautions the public to be mindful of thi= s fact in its dealings with the company.

"The public is also kindly advised to furnish the Bank of Ghana with any relevant information they may have on any unlicensed financial institution and/or such unauthorized activities."

General News of Monday, 31 January 2011

Source: GNA