Private sector credit continued to grow in the first eight months of the year to 21.7 per cent in August 2024, from 10.7 per cent in August 2023.

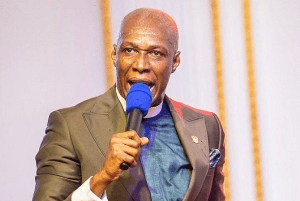

In real terms, private sector credit recorded a growth of 1.1 per cent, relative to a 21.0 per cent contraction in 2023, Bank of Ghana Governor Ernest Addison told journalists on Friday during a media briefing on the Monetary Policy Committee’s decision to cut the policy rate from 29 per cent to 27 per cent.

He said on a year-on-year basis, money market interest rates broadly trended downwards.

The 91-day and 182-day Treasury bill rates declined to 24.85 per cent and 26.76 per cent respectively, in August 2024, from 26.35 per cent and 27.84 per cent respectively, in the corresponding period of 2023.

Similarly, Dr Addison noted that the rate on the 364-day instrument declined to 27.90 per cent in August 2024 from 30.88 per cent in August 2023.

Also, he said the weighted average lending rate on the interbank market increased.

The rate increased to 28.84 per cent in August 2024 from 26.59 per cent in August 2023, he detailed.

The average lending rates of banks to households and firms over the period declined marginally to 30.79 per cent in August 2024 from 31.78 per cent in August 2023, Dr Addison added.

Watch Chief Alhassan Andani as he spells out his financial blueprints to surviving this economy

Business News of Tuesday, 1 October 2024

Source: classfmonline.com