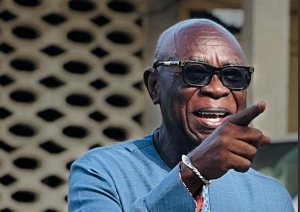

The president of the Ghana Bankers Association, Alhassan Andani, has lauded the revocation of the licenses of UT and Capital Banks over insolvency.

The Central Bank in August announced the revocation of the licenses of the two banks due to severe impairment of their capital and as a result it “approved a Purchase and Assumption transaction with GCB Bank Limited that transfers all deposits and selected assets of UT Bank Ltd and Capital Bank Ltd to GCB Bank Ltd.”

While the remaining assets and liabilities will be realised and settled respectively through a receivership process to be undertaken by Messers Vish Ashiagbor and Eric Nana Nipah of PricewaterhouseCoopers, it added in a statement.

The collapse of UT and Capital banks sparked fears in the sector that there are more banks which are exposed in similar fashion.

But speaking in an interview with Starr News’ Ibrahim Alhassan, Mr. Andani who is also the Managing Director of Stanbic bank allayed fears more local banks will suffer same fate as the aforementioned banks.

“I think we have recovered. We have to commend the Bank of Ghana in the manner of dissolutions of those banks because for us in the industry it is about the confidence of our customers and the dissolution made sure that the depositors sitting with those banks were impacted in any shape or form,” he said.

Meanwhile, he cautioned banks against overexposure saying, “Our economy is quite fluid and it is quite volatile as well and therefore don’t sail too close to sand.”

Business News of Wednesday, 27 September 2017

Source: starrfmonline.com

Revocation of licenses of UT, Capital Banks apt – Andani

Entertainment