Critical Ideas Limited trading as Chipper Cash, a cross-border payments app serving over five million users across Africa and its diaspora, has been granted a broker-dealer license by Ghana’s Securities and Exchange Commission (SEC). This new license will allow the fintech company to operate in the country's financial markets, significantly expanding its range of services.

The license gives Chipper Cash the legal authority to engage in the brokerage of securities, serving both individual and institutional clients. By facilitating trades, the company is poised to generate substantial revenue through commissions and fees. The license also provides Chipper Cash with direct market access, allowing for faster trade execution and more competitive pricing, positioning it ahead of competitors without such privileges. As a market maker, the company can create an additional revenue stream and cement its status as a key player in the financial markets.

By offering wealth management services, long-term financial planning, and estate planning advice, Chipper Cash can further diversify its revenue sources. The fintech firm will also have the flexibility to adopt various pricing models, such as tiered commissions or volume-based discounts, making its services accessible to a broader client base.

For users of the Chipper Cash app, the license enables new features, including in-app securities trading. This will allow customers to buy and sell stocks, bonds and other securities directly within the app, making it a one-stop-shop for managing investments. Additionally, the app will offer personalised investment advice using AI and data analytics, as well as access to Initial Public Offerings (IPOs), providing users with early opportunities to invest in companies going public.

The app's capabilities combined with the legitimacy conferred by the broker-dealer license, will significantly enhance trust and user engagement. Chipper Cash also plans to introduce fractional investments, enabling users to invest in high-priced stocks or ETFs with smaller amounts of money, a feature likely to appeal to younger or novice investors.

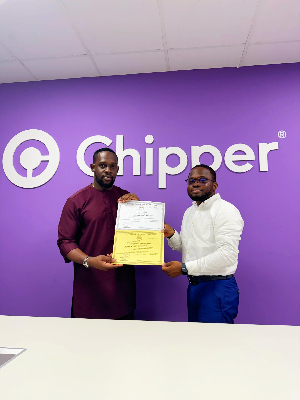

Chipper Cash has already received two key authorisations from the Bank of Ghana, including a license for remittance services from the United States and an Enhanced Payment Service Provider License. The addition of the broker-dealer license solidifies the company’s foothold in Ghana’s financial market.

Commenting on the new development, Mr Dion Jon Taylor Samson, Chief Executive Officer of Chipper Cash in Ghana, said, “It is very important for every entity that enters a market to adhere to the rules and regulations set by the regulatory bodies. While it can be time-consuming and sometimes frustrating, it ensures longevity in the business and protects both the company and its customers. We are excited to bring innovations in the financial market into the digital payment space.”

With its broker-dealer license, Chipper Cash is poised to transform the digital payments and investment landscape in Ghana, further integrating financial services across the continent.

General News of Tuesday, 10 September 2024

Source: starrfm.com.gh