The Office of the Special Prosecutor has begun investigations into the controversial Agyapa Minerals Royalties Investment deal over suspected “commission of corruption.”

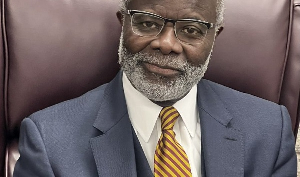

In this regard, the office, under the signature of the Special Prosecutor, Martin A.B.K. Amidu, has written to Parliament requesting from it information on the deal within seven days.

In a letter addressed to the Clerk to Parliament dated September 10, 2020, cited by the Ghanaian Times, Mr Amidu said the intended probe was in line with of his office’s mandate to exercise the functions and powers of the prevention of corruption.

“I write in pursuant to Sections 2(1) c, 29 and 73 of Act 959 and Regulation 31 (1) and (2) of L. I. 2374 mandating the office to exercise the functions and powers of the prevention of corruption, to request you to provide this office with information and all documents related to and/or in connection with the approval given by Parliament to the Agyapa Royalty Transaction to assist this office to execute its prevention of corruption object,” it said.

It continued: “Your timeous compliance with this statutory notice of request will enable the office to present to government and relevant agencies of government any finding and recommendation on the said transaction or its processes which may be inconsistent with the provisions of articles 257 (6) and 268 of the 1992 Constitution and the existing laws on ownership of all the mineral resources in Ghana, and the fiduciary responsibilities entrusted to the President of Ghana as the trustee holding all such mineral resources of the Republic of Ghana in trust for and on behalf of the people of Ghana.

“This office will be concentrating on any potential of the said transaction to promote and facilitate the suspected commission of corruption and corruption related offences and advise government accordingly.

“In view of the public interest generated in this matter in the tense election environment this year, it will be highly appreciated should you make the requested information available to the office and produce the required documents to this office on or before Tuesday, September 17, 2020,” the letter said.

The House, by a Majority decision, approved the deal on August 14, in line with the Minerals Income Investment Fund (MIIF) Act, 2018 (Act 978).

The deal has since generated controversy with Civil Society Organisations (CSO) kicking against the agreement, which is intended to raise between US$500 and US$750 million to finance capital expenditure.

According to the coalition of CSOs working on extractives, anti-corruption and good governance, the needed consultations were not done before the deal was approved by Parliament.

“What we find even more repulsive about this whole transaction is the provision that permits Agyapa Royalties, a supposed company of the sovereign state registered in a tax haven, to borrow money or raise equity in foreign currency from any source on the back of the gold royalties of Ghanaians without the requirement for any further approval, consent or administrative act of the Government of Ghana,” spokeperson for the CSOs, Dr Steve Manteaw said at a press conference last month.

“The Agyapa transaction is not a mystery. The transaction has been transparent; it’s gone to Parliament on many levels, it’s gone to cabinet on many levels, and there is truly nothing to hide except creating something new,” Finance Minister, Ken Ofori-Atta had said at a press conference

Per the deal, 75.6 per cent of royalties of at least 16 gold mining companies would go into Agyapa Royalties Ltd.

To be listed d on the London and Ghana Stock Exchanges, Agyapa would float 49 per cent shares valued at US$1bn.

Agyapa Royalties is incorporated under the laws of Bailieick of Jersey, a tax haven in the UK.