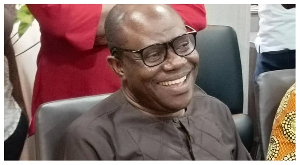

The Governor of the Bank of Ghana, Dr. Peter Acquah, has stated that the stability of the cedi against major international currencies is real.

He said the stability has been achieved by limiting borrowing by the central government and by shifting government’s financing from bank to non-bank sources through co-coordinated open market operations.

The stability is a strong market reaction to the recent policy to bring sanity into domestic liquidity and to streamline the external payments position.

The stability of the currency has been the major achievement of the 11-month old Kufuor government.

Speaking at a dinner to round off activities marking this year’s Bankers Week celebrations of the Charted Institute of Bankers, Dr. Acquah said monetary policy would focus on firmly strengthening the value of the cedi in the coming year to achieve a sustainable growth in the economy.

This, he said will help achieve a durable drop in inflation and sustainable reductions in interest rates. He explained that this will increase confidence in market activities and make investment decisions sustainable so as to generate employment.

Dr. Acquah said there has been a substantial increase in savings and timesavings relative to foreign currency deposits, adding, “ this reflects an increase in confidence in domestic asset as the macro economy has began to stabilise.”

The gains that have been made so far require credible commitment to sound management and an all round market discipline, the Governor said, adding, this can be achieved through cost reduction at the public sector level, increased productivity and improvement in asset portfolios.

Dr. Acquah said banks and non-bank financial institutions have a role to play in building such confidence through the provision of innovative products, effective mobilisation of resources and allocating them efficiently for productive use.

The BOG however says it would promote price stability and defend the value of the cedi through open market operations, discount rate adjustment, re-purchase and reverse re-purchase agreements and activities of government debt instruments of various maturity.

Dr. Acquah said it is the policy of the BOG to foster the development of a secondary market for government securities and intimated that this will be facilitated by improving settlement facilities, listing of government securities on the stock exchange and offering bills and bonds with different maturity profiles.

The President of the Charted Institute of Bankers, Dr. Jean Nelson Aka said the banking industry appreciates the bold steps that have been taken by the government during the past eleven months to stabilise the macro-economic environment and thus provide the necessary impetus for business growth.

He said the laudable developments in the economy are the result of the prudent measures taken by the government to rationalise its expenditure and reduce waste.

General News of Monday, 26 November 2001

Source: .