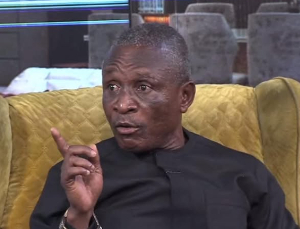

Atik Mohammed, a former General Secretary of the People's National Convention, has entered the discussion regarding Ghana's successful agreement with Eurobond holders to restructure commercial debts of $13.1 billion.

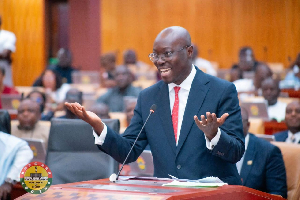

Ghana has reached an agreement with two bondholder groups to restructure some $13 billion of international debt, a significant step in the country's economic recovery under an International Monetary Fund (IMF) loan deal.

The agreement, which will see Eurobond holders take a haircut of 37 percent or $4.7 billion in addition to delayed repayments, represents the third and final step in the country's external debt restructuring negotiations.

The Committee of Holders of Ghana's Eurobonds (the Committee), which announced this yesterday, said the proposed agreement on the restructuring of the Eurobonds would resolve Ghana's default on the Eurobonds in a manner that provided significant cash flow and debt stock relief to support the country's economic recovery, as stated in a publication on Graphic.com.

Atik Mohammed, commenting on the agreement during Peace FM's "Kokrokoo" morning show, expressed happiness about this success but cautioned the authorities in charge of Ghana's finances against taking delight in borrowing.

He stressed, "There is nothing smart about borrowing. So, whether you go and borrow 10 billion at a coupon rate of 5 or 10, at the end of the day, it is debt, and debt must be paid. And looking at Ghana, we have always complained; if you look at our revenue or revenue collection effort, it is not encouraging."

Atik explained that Ghana's borrowing culture is disturbing because "I don't remember the last time that, in Ghana, we had a surplus fiscal balance, which means that at every point we are always in deficit, but how we manage those deficits or the levels that we keep the deficits is the important thing."

"When you have a deficit, there are two ways to finance it. Either you print money or you borrow, and recently, we can't print money, and we can't monetize our debt anymore...So, what you do is to borrow," he added, explaining why the nation is on a borrowing spree.

He hoped the managers of the economy will take advantage of this debt restructuring program and revive the economy.

General News of Wednesday, 26 June 2024

Source: peacefmonline.com