The Head of the Financial Integrity Office at the Bank of Ghana, George Nkrumah, emphasized in December 2019 that financial institutions should conduct thorough background checks on potential employees to ensure they are trustworthy.

He highlighted the importance of verifying qualifications and checking for any criminal records to minimize fraud within the banking sector.

“…When you are employing, you have to do Know Your Employee (KYE). Know the person you are recruiting. Make sure you do a verification of their qualifications; check with the police Criminal Investigations Department about any criminal record…The Bank of Ghana also has a database of persons that may have caused certain fraud in banks — employers must crosscheck potential employees against this database to ensure criminals are not recycled,” Mr Nkrumah said.

Read the full story originally published on December 15, 2019, by mynewsgh.com

The Bank of Ghana has advised financial institutions to conduct thorough background checks before employing workers, in light of the rising cases of fraud perpetrated by employees, particularly bankers.

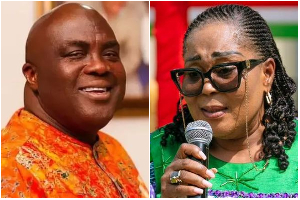

“When employing, you must implement Know Your Employee (KYE). Know the person you are recruiting. Ensure you verify their qualifications, and check with the police Criminal Investigations Department for any criminal records. The Bank of Ghana also maintains a database of individuals involved in bank-related fraud. Employers should cross-check potential employees against this database to prevent criminals from being recycled,” advised Mr. George Nkrumah, head of the Financial Integrity Office at the Bank of Ghana.

He made this statement during the opening of a workshop organized by the central bank in collaboration with the Committee for Cooperation between the Law Enforcement and Banking Community (COCLAB).

Mr. Nkrumah emphasized the importance of banks taking employee background verification seriously to mitigate the rising incidents of employee fraud in the banking sector.

His comments follow reports that commercial banks lost nearly GH¢20 million to employee-related fraud last year.

According to the 2018 Bank of Ghana report, commercial banks lost approximately GH¢20 million to fraud, most of which was perpetrated by their own employees.

In percentage terms, cases of employee fraud increased by 50% in 2018 compared to 2017, with employee-related fraud rising by 78%.

The Bank of Ghana has therefore stressed the need for financial institutions to implement rigorous Know Your Employee (KYE) processes to address this growing concern.

Watch the latest edition of BizTech below:

Click here to follow the GhanaWeb Business WhatsApp channel

Click to view details

Business News of Monday, 16 December 2024

Source: www.ghanaweb.com