A leaked report on the operations of uniBank prepared by KPMG and sighted by Starrfmonline.com reveals that the audit firm expressly warned the Bank of Ghana that it did not conduct an audit into the finances of uniBank contrary to the publicly expressed position of the Central Bank.

KPMG which was appointed official administrator of uniBank also told the Central bank that it did not undertake operations that could help them express an audit opinion on the operations of uniBank.

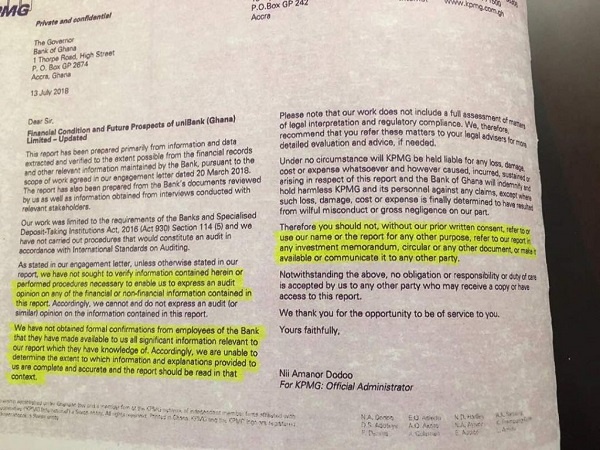

A report submitted to the Governor of the Central Bank on July 13, 2018 said: “As stated in our engagement letter unless otherwise stated in the report, we have not sort to verify information contained herein or performed procedure necessary to enable us express an audit opinion on any of the financial or non-financial information contained in this report. Accordingly, we cannot and do not express an audit opinion on the information contained in this report”.

The letter stressed: “We have not obtained formal confirmation from employees of the bank that they have made available to us all significant information relevant to our report which they have knowledge of. Accordingly, we are unable to determine the extent to which information and explanations provided to us are complete and accurate and the report should be read in that context”.

Portions of the report also noted: “We have not undertaken any work to establish the reliability of the source of information made available to us and presented in this report by reference to evidence independent of the bank or other relevant source.

“The procedure we have performed did not constitute an audit and consequently, no assurance is expressed”.

However, the Central Bank, on the supposed audit report of KPMG declared uniBank insolvent and merged it with four other banks to create the new Consolidated Bank of Ghana Limited.

“The Official Administrator appointed for uniBank in March 2018 has found that the bank is beyond rehabilitation. Shareholders, related and connected parties had taken amounts totaling ¢3.7 billion which were neither granted through the normal credit delivery process nor reported as part of the bank’s loan portfolio.

“In addition, amounts totaling ¢1.6 billion had been granted to shareholders, related and connected parties in the form of loans and advances without due process and in breach of relevant provisions of Act 930,” the Governor of the Central said of uniBank during the announcement of the decision on consolidated uniBank and four other banks to create the Consolidated bank.

Below is the full report of KPMG on uniBank

General News of Sunday, 19 August 2018

Source: starrfmonline.com