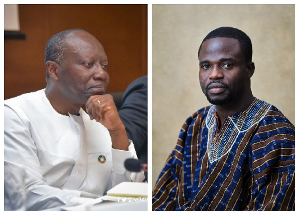

Renowned investigative journalist Manasseh Azure Awuni, in his latest publication, ‘The President Ghana Never Got’, has disclosed how some individuals in the Nana Addo Dankwa Akufo-Addo government benefited from Ghana’s woes of high indebtedness.

In his 409-page book, the journalist shared copies of documents he obtained from the Ministry of Finance through a Right to Information request, which showed that the bank of former Minister of Finance Ken Ofori-Atta, Databank, made millions of dollars from the country’s indebtedness.

Details of the book, which were published by myjoyonline.com, showed that as Ofori-Atta was signing debt instruments which were pushing the country into a ditch, Databank was making millions of dollars.

The bank, together with two other financial institutions, became the regular facilitator of the Akufo-Addo government’s borrowing when Ofori-Atta became finance minister, and it benefited greatly from both Ghana’s international and domestic debts.

The documents disclosed that Ofori-Atta’s Databank made a whopping US$9.2 million through the loan agreements it facilitated for the country while he (Ofori-Atta) was in office.

Below is a breakdown of the US$9.2 million as documented in Manasseh Awuni’s ‘The President Ghana Never Got’, according to myjoyonline.com:

“There was no Eurobond in 2017. In 2018, Ghana issued a US$2 billion Eurobond. The three financial companies—Fidelity Bank, IC Securities, and Databank—earned US$375,000 each as Co-Managers (CoM). In 2019, Ghana issued a US$3 billion Eurobond. The three companies—Fidelity Bank, IC Securities, and Databank—again received US$375,000 each as Co-Managers (CoM) fees and US$50,000 as sub-CoM. In 2020, Ghana issued another US$3 billion Eurobond. The three companies—Fidelity Bank, IC Securities, and Databank—earned US$375,000 each as Co-Managers (CoM) fees and US$50,000 as CoM.

“In 2021, Ghana issued a US$3.025 billion Eurobond. Four companies—Fidelity Bank, IC Securities, Temple Investment, and Databank—earned US$166,375 each as Co-Managers (CoM).

“So, between 2018 and June 2021, the Finance Minister's Databank earned US$1,182,750 from Ghana's borrowing through Eurobonds under his signature.

Databank was also paid GH¢48.2 million when it helped the government borrow GH¢79.21 billion in the domestic bond market within the same period.

“Together with the Eurobond, Databank earned GH¢55,267,82 million between 2018 and 2021. This was about US$9.2m at the time,” portions of the book read.

BAI/ADG

Watch the latest episode of #SatItLoud on GhanaWeb TV below:

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.

General News of Friday, 9 August 2024

Source: www.ghanaweb.com

While Ghana was wallowing in debts, Ofori-Atta’s bank made US$9.2m – Manasseh Azure's new book reveals

Entertainment