A Member of Parliament’s Finance Committee Isaac Adongo has rubbished claims to the effect that the Bank of Ghana (BoG) is a model of emulation for other Central Banks in the West African sub-region for good management system and practices.

The Ghanaian Central Bank in a statement issued on January 3, 2020, said it has received several commendations and has become a model for peer economies that have visited the country to learn from its currency management system.

The BoG further named countries like Kenya, Sierra Leone, Liberia, Uganda, Nigeria, South Africa, Seychelles, India, Mozambique and many more in Africa and Middle East as those that admiring and using the modus operandi of the Bank of Ghana to strengthen their operations and policy decisions implementation.

“Indeed, Ghana maintains a very strict clean note policy, making our currency the cleanest across the West African sub-region. This is because, since redenomination, we have put into place a modern and world-class currency management and processing systems to meet the country’s currency needs” the BoG statement added.

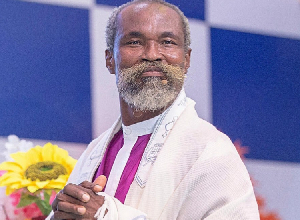

However, the vociferous Member of Parliament (MP) for Bolgatanga Central Constituency Isaac Adongo disagrees with the self-glorification claims of the Bank of Ghana.

He berated the regulator over its implementation of a decision to issue new higher denomination notes among others and further argued that the Bank of Ghana cannot claim to be a model for other Central Banks in West Africa when it gleefully engaged in cooking of figures and data.

“Which serious country will learn from BoG, a central bank that cooks monetary policy data unless the Dr Addison-led central bank is able to conceal this from them as it had tried without success to conceal same from the Ghanaian people?

Which serious country will learn from a BoG that cooked Ghana’s net international reserves when it was so low and added $1.5 billion to our NIR in 2018 to fool the IMF?

Which serious country will associate with this fraud, unless that country is unaware of it” he wrote in an article sighted by MyNewsGh.com.

According to him, Ghana’s central bank in September 2019, mendaciously cooked its deteriorating capital adequacy ratio in the banking sector by adding 3% to the worsening rate to hide the failed banking sector cleanup and has also failed to comply with its obligations to report to Parliament for its functions and special exercises under Section 4 of its Act as required by Section 53 (A) of its amended Act for almost 2 years in respect of 2018 and the financial sector collapse?

“No serious country learns from a lawless and non-compliant compliance officer like BoG,” he said.

In the assertion of the lawmaker, the Bank of Ghana has lost its independence and is now an appendage of the executive and used essentially for political witch-hunt in the name of financial sector reforms.

General News of Monday, 6 January 2020

Source: mynewsgh.com