Former President John Mahama has accused the Bank of Ghana of collapsing 20,000 direct jobs through its “chaotic” and “national-security-threatening” clean-up exercise of the financial sector, which saw the revocation of licences of a cornucopia of 420 banks, microfinance institutions and other finance houses within the past one year at a cost of GHS20 billion to the taxpayer, per his estimation.

By Mr Mahama's calculation, if the number of indirect jobs lost are tabulated and added to the 20,000, the number could be nearing 50,000.

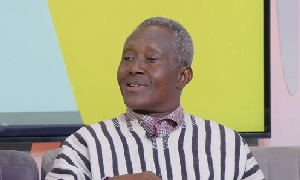

“About 20,000 people have lost jobs directly due to the 420 financial institutions that have been shut down”, Mr Mahama claimed on Thursday, 22 August 2019 in a Facebook Live interaction with Ghanaians.

“We have not even added the indirect jobs”, he said, adding: “By the time we do, the total calculation, about 40,000 to 50,000 people may have lost their jobs,” he added.

According to the flag bearer of the main opposition National Democratic Congress (NDC), “The crisis has created major problems in the banking sector and financial sector including deepening the already widely-held mistrust and lack of confidence in the system by Ghanaians”.

“It appears to have no end in sight”, he said, lamenting: “It has also dealt a significant blow to the indigenous banks because such institutions have no external support to count on”.

“While this development appears to be a threat to only the businesses that have been shut down, it is, in fact, a threat to our national security”, Mr Mahama asserted.

“The development in the banking and finance system and the matters arising call for grave concern on all who have been affected by this financial sector turmoil, especially because it is an issue that threatens the country’s security”, he stressed.

Mr Mahama said his party stands with all those who have been affected by the chaotic path chosen by the central bank.

“Was the revocation the best option at this circumstance or there was no option? Our central bank chose the chaotic situation with accompanying huge debt where the government has no clue on how to clear it.”

“Revocation of licences would have been the last resort and not the first resort. No country is immune to crisis in the financial sector,” he added.

General News of Thursday, 22 August 2019

Source: classfmonline.com