The latest move by the Salva Kiir administration to abolish the use of the US dollar in transactions has been received with mixed reactions by regional businesses with operations in South Sudan.

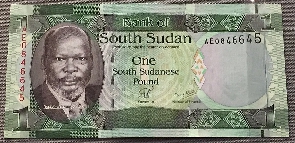

The Bank of South Sudan recently directed that all local transactions be in the South Sudan Pound to rein in inflation and the attendant cost of living and lockout dollar speculators.

Some regional businesses have seen it as the right move while others fear that it might cause capital flight.

The EastAfrican understands that while Juba is pushing to tame the high cost of living through the de-dollarization of the economy, the country is also at risk of losing significant foreign direct investment as a result of the policy shift.

Average FDI inflows

Data from the East African Community put South Sudan’s yearly average FDI inflows at $1.82 billion. Kenya and Tanzania are some of South Sudan’s leading sources of FDI. Others are China, India, Lebanon, South Africa and Egypt.

If Juba pursues further de-dollarisation of the economy, isolation from global integration involving the US and other Western nations would cause capital flight due to devaluation of the South Sudan Pound (SSP), increased cost of foreign borrowing and reduction in the credibility and predictability of the economy.

The Bank of South Sudan (BoSS) has restricted the use of the US dollar in local transactions in favour of the highly volatile SSP and ordered government institutions to sign dollar-based global contracts under the oversight of the Ministry of Finance and Planning, effective January 27, 2023.

Mixed reactions

The move has elicited mixed reactions from investors, with fears that commercial activities in the country will be impacted. The move is likely to affect banking, aviation, operations of government and financial institutions, NGOs, hospitality, travel agencies, commercial agencies, the service industry, entertainment and private businesses that have heavily relied on the US currency for transactions.

The BoSS, in a circular dated January 27, 2023, said the “unacceptance” of the US dollar has fundamentally undermined and threatened to erode public confidence in the SSP as a legal tender and must be entirely “discouraged.”

“It’s strictly prohibited for any institution, official or private within the legal jurisdiction of the Republic of South Sudan to denominate its commercial transactions in any currency other than SSP. These include rent fees, travelling industry, hotels, entertainment services, restaurants, commercial outlets and as well as the private services contracts and monetary dealings,” said the circular by BoSS Governor Johanny Ohisa Damian.

“Prices for all goods and services in the Republic of South Sudan shall be denominated in South Sudanese Pounds unless otherwise stated.”

Affect lenders’ operations

The Kenya Bankers Association said the move to abandon the US dollar could affect the operations of Kenyan lenders with operations in the country, which could be forced to devise tactics to survive.

“Yes, there will be a challenge to those banks that are operating there and the way forward will be specific to the individual banks. It is not an industry issue,” said Habil Olaka, the association’s CEO.

Kenyan banks operating in the country— KCB, Equity, Co-operative and Stanbic — have been recording reduced profits, with some posting losses as a result of hyperinflation and the devaluation of the SSP.

A banker who asked not to be named said the dollar ban was rushed and would lead to loss of business and capital flight.

“If you look at the structure of the South Sudanese economy, it is largely driven by foreigners. For instance, most banks, service providers and NGOs are all foreign. Even most of the landlords in Juba are foreigners and they would demand to be paid rent in US dollars,” the banker said. “So if you tell people to switch to SSP — which is volatile — then they are likely to have their transactions executed through banks outside South Sudan.”

Taming speculation

But James Mwangi, CEO of Equity Bank Holdings, holds the view that the ban is important in taming speculation on the greenback and preserving the value of the local currency.

“The ban is a positive move for the country and Equity Bank because it removes artificial demand for the US dollars and speculation. Dollars are for imports and not local transactions,” said Mwangi. “For us, it is a good move because it reduces demand pressure on dollars for speculative purposes.”

Click to view details

Africa News of Saturday, 18 February 2023

Source: theeastafrican.co.ke