If pipo sabi wen dem go die, dem fit to plan who go manage dia property and oda assets.

For dose wey don work hard for dis life wey dey acquire some properties, e dey necessary say sombodi go inherit dis tins.

Aside properties, some pipo die wit moni in dia bank account and oda e-commerce apps.

Recently, pipo bin dey tok inside skit on top social media say dem no go struggle to make dia own moni sake of dem get relatives wey get moni - na so if dem die, dem go inherit di moni and oda tins as di next of kin.

Wetin be dis next of kin?

Financial institutions dey ask for some information from customers if dem don dey open dia bank account.

Di reason be say dem wan dey able to identify and contact di account holder if somtin happun to di account.

One of di key tins di banks and oda investment companies dey ask for na next of kin.

Di next of kin na di account holder close relative or pesin wey dem fit to contact if dem no fit reach di pesin wey get di account.

Wetin don dey happun usually be say di bank go ask make di owner of di account provide di name, address and phone number of di pesin dem choose as next of kin.

But e dey mean say dis pesin wey dem choose, automatically dey inherit di bank account holder moni and assets?

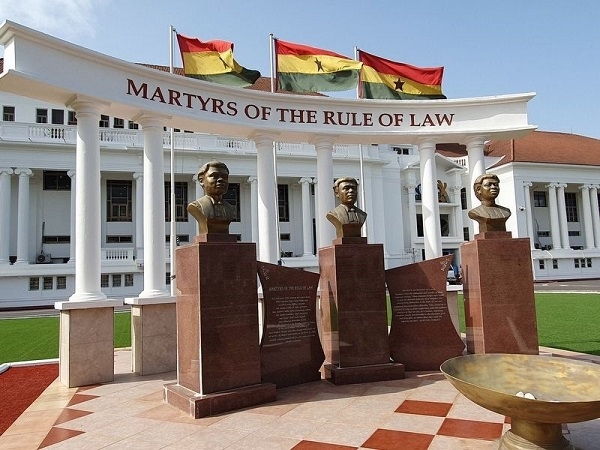

Wetin di Bank of Ghana tok

Di central bank of Ghana bin tok say pipo tink say na automatic say dem go inherit moni inside di account if di owner don die.

But dat neva be di case.

Dis na wetin di Bank of Ghana tok for one press release.

*Di pesin wey dem choose as next of kin neva dey automatically inherit or gain access to di account or moni inside di account of pesin wey die.

*To get access to dead pesin account and moni, di account holder gatz name you inside dia will.

Di central bank say e dey important say pipo go choose dia next of kin as pipo wey dey capable to provide relevant information about di account holder if dem die.

Dem don sum up di mata say even though dem don name pesin as next of kin for di opening of bank account, dis pipo still gatz provide legal documents like death certificate, letters of administration or letters of probate bifor dem fit to access di account of pesin wey die.

Di Bank of Ghana policy through di specialised deposit-taking institutions act, act 930 2016 bin dey “require say banks for contact di next of kin of any account holder to find out wia di owners dey, if di account bin dey dormant for more dan three years.”

If afta dis three years di accounts still dey dormant, any moni wey dey inside go dey transferred to di Bank of Ghana.

Wetin Ghana inheritance law dey tok

One of di requirements especially for di banks - for di next of kin na say im gatz dey of legal age.

“As much as possible, we don dey encourage pipo say make dey choose next of kin wey dey of legal age. Im gatz be pesin wey fit make decision or get say for di account holder mata,” di Bank of Ghana tok for dia statement wey dia secretary sign.

One ogbonge lawyer Andrew Nii Adjei Khartey tell BBC News Pidgin say di rules of inheritance for Ghana dey provide two major ways wey pesin fit benefit for di property/moni of di owner wey don die.

Di first one, wey dey obvious na say pesin wey die, don leave will behind.

Lawyer Khartey explain say, “If pesin wey die, leave a will, dis mean say di pesin don clearly put down instructions about how dem go distribute im property.”

“For dis instance, di pesin wey die go also name executors wey go ensure say di instructions im give inside di will, go dey respected to di end,” im add.

Wetin di executors go do be say dem go go court “to apply for wetin dem dey call probate. Dis probate na di order from di court wey go give di executors di go-ahead say make dem distribute di property or moni of di pesin wey die, according to di instructions of di pesin wey die".

Oga Andrew Nii Adjei Khartey tell BBC News Pidgin say for di oda aspect wia pesin die witout a will, some pipo dey entitled to wetin dem dey call letters of administration - usually priority list dey, like di spouse, pickins, parents or customary successor of di pesin wey die.”

“Dis pipo fit to apply to di court for di letters of administration. Remember say for dis instance, di pesin wey die neva leave any instructions on how dem go distribute im property. But di distribution of di property gatz dey in accordance wit PNDC Law 111.”

Dis PNDC law 111 dey deal wit distribution of di properties of pesin wey die witout a will.

During di period bifor di 1980s, many widows and surviving pickins of pesin wey die bin suffer oppression under di customary laws of inheritance.

For dat time, dem dey deny dem di benefit of inheriting properties of dia husbands and fathers wey don die.

Dis law na one of di solution wia di PNDC set, say make e deal wit dat kain wahala.

Dis law bin dey in force for Ghana from 14 June 1985 and e still dey in force till now.

Under dis law, five pipo dey recognised say dem fit inherit di property of pesin wey die, if di pesin neva write will.

Dis group of pipo na di surviving spouse, pickins, parent, extended family or di administrator general (wey go dey responsible for di properties if di goment don take am).

Wit dis explanation, Oga Andrew Nii Adjei Khartey tok say, “E neva dey automatic say pesin wey dem name as next of kin for bank documents go inherit di dead pesin account. Sake of say di instructions inside di pesin will go determine how dem go distribute di moni or who go inherit di account. Pesin inside di will of di dead pesin fit dey different from di pesin im take open di account.”

“If di pesin no get will also, na di PNDC law 111 go determine how dem go distribute di moni, property, pension and oda insurance of di dead pesin.”

Oga Andrew Nii Adjei tok say, “For di Social Security and National Insurance Trust (SSNIT), wey require say di contributor go name im beneficiaries, dat one dey like say di pesin don write will. So di pipo wey im present as beneficiaries of im SSNIT contributions go inherit moni for dat side. Dis one dey different from next of kin arrangement as pesin dey open dia bank account.”

Some of dis processes bin dey drag

One lawmaker for Ghana parliament and human right lawyer Francis Xavier Sosu bin dey advocate say make di Bank of Ghana “simplify di concept of next of kin for account holders so say di beneficiaries fit to access di benefits quick quick.”

Im tok say,“We gatz to develop standard approach for all beneficiaries - wey e dey require di attorney general office and di bank of Ghana demsef.”

During one policy dialogue by some ogbonge civil society groups for 2023, di lawmaker tok say make “dem remove di administrative barriers wen pipo wey no go school dey fill forms for dia next of kin".

Di lawmaker call on banks say make dem “digitise di administrative process on next of kin, so di plenti wahala wey dey associated wit dis arrangement, go reduce.”

Im also advise say make pipo wey dey open accounts understand di effect of filling bank and pension forms wen dem dey choose next of kin.

Di Bank of Ghana say no be automatic say next of kin go inherit moni wey dey for dead pesin bank account

Court gatz give order wey go allow make executioner carry out wetin dey inisde will of pesin wey die

Click to view details

BBC Pidgin of Friday, 30 August 2024

Source: BBC