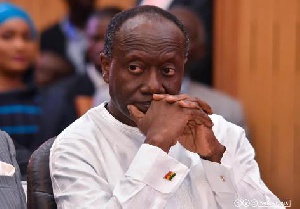

Finance Minister Ken Ofori-Atta has been summoned by parliament to answer questions relating to the US$2.25 billion bond issued recently.

Speaker of Parliament Prof Mike Oquaye issued the summons on Wednesday May 31 after some legislators raised eyebrows about the deal, Class FM’s parliamentary correspondent Ekow Annan reported.

The Finance Minister has been given a week to prepare and make an appearance to clarify issues concerning the bond.

The directive follows a motion by Minority Leader Haruna Iddrisu who requested the minister to appear before the house to provide detailed information on the bond.

Background

The Minority in Parliament had accused Mr Ofori-Atta of engaging in a conflict of interest situation as far as the issuance of the $US2.25billion 15-year bond was concerned.

The Minority, at a press conference, said US-based firm Franklyn Templeton Investment Limited, which bought almost 95 per cent of the domestic bond, had private dealings with Mr Ofori-Atta.

The Minority said: “Information that is now available in the public domain appears to indicate that Hon. Trevor G. Trefgarne is not just Board Chairman of Enterprise Insurance Limited, a company owned partially by the current Finance Minister’s company, Databank Limited. Hon. Trevor G. Trefgarne is also a Director of Franklyn Templeton which is the main participant in the recent Bond issuance.

“Putting these apparent facts together, we have reason to believe that there is a relational interest between our Finance Minister and Trevor G. Trefgarne which creates a potential lack of transparency and conflict of interest. As we all know, the constitution provides unequivocally that public officers shall not put themselves in a situation in which their private interest conflicts with their public obligations. There is no record available to us to the effect that the Finance Minister made known publicly this relational conflict of interest.

“In other words, he failed and/or neglected to declare his relationship with Trevor G. Trefgarne and the extent to which that relationship might have potentially affected the decision to sell majority of the bonds to Franklyn Templeton. Furthermore, there is no disclosure as to the extent to which the determination of the price of the bonds could also have been affected by this relationship between the Finance Minister and Franklyn Templeton.

“Now that a good link has been established between the Finance Minister and his friend Trevor, it is clear that the Finance Minister issued this bond in a way that will favour his friend, family and business partners. This situation is best described as cronyism and nepotism, cooked for his friend and associates, and not transparent.

“Under these circumstances, we wish to call for a full-scale parliamentary inquiry into whether, and the extent to which, this situation of lack of transparency and conflict of interest has adversely affected the welfare of the people of Ghana. Failing such parliamentary inquiry we the Minority shall have no option but to resort to using the conflict of interest jurisdiction of the Commission on Human Rights and Administrative Justice (CHRAJ). Furthermore, we also intend to exercise the option of filing a report/petition with the Financial Services Authority of the U.S.A to investigate Franklyn Templeton.

“We also wish to point out that this bond issue is clearly an international economic/business transaction within the meaning of article 181 (5) of the constitution. Therefore, we expected that the bond issuance would have been brought to parliament for approval.

This is because although the transaction appears as to be a domestic sale of bonds, it is in truth a “private placement” and an international economic transaction given the fact that Franklyn Templeton is a United States registered company and, therefore, qualifies as a foreign entity under article 181 (5) of the constitution. We, therefore, call on the Finance Minister to provide parliament with the full complement of documentation on this transaction for scrutiny and ratification.”

Click to view details

Business News of Wednesday, 31 May 2017

Source: classfmonline.com