Ahead of the 2024 budget presentation, the Ghana Union of Traders Association (GUTA) has called on the government to restructure the Value Added Tax (VAT) system to ensure the same rate is paid across board.

The Association argues that the system currently has loopholes where some businesses often pay a rate of 22 percent, others paying 4 percent, while others are completely exempted from VAT due to meeting the threshold of GH¢200,000 worth of goods.

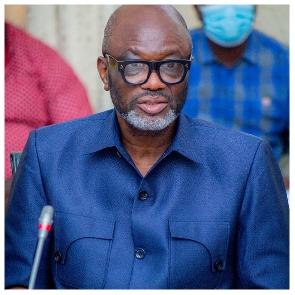

GUTA president, Dr Joseph Obeng, emphasized that the situation must be critically looked at in the budget as many businesses may be disadvantaged due to the development.

“The consumer has the discretion of buying what he or she wants, the one paying 22 percent VAT and those paying 4 percent VAT stand at a disadvantage since their goods are likely to be priced high while those not paying any VAT at all sell at affordable prices and are able to make good sale,” he noted.

Dr Obeng further called on the government to adopt pragmatic measures to ensure the exchange rate regime is stabilised, while certain nuisance taxes such as the 2% special import and COVID-19 health levy are scrapped.

“Ghanaian businesses are overly saddled with taxes. We also have to contend with high interest rates. Aside that, we are being consumed with inflation, we want the 2024 budget to address this,” Dr Joseph Obeng is quoted by Graphic Business to have said.

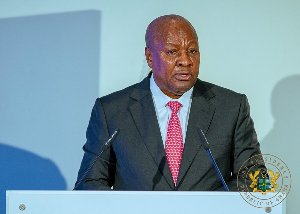

Meanwhile, the Minister of Finance, Ken Ofori-Atta, is expected to present the 2024 budget before parliament on November 15, 2023.

MA/AE

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.

Business News of Tuesday, 14 November 2023

Source: www.ghanaweb.com

2024 Budget: Restructure VAT system to address loopholes – GUTA

Entertainment