The Bank of Ghana (BoG) has disclosed that the licenses of over 50 micro-finance institutions will be revoked by the end of September 2015.

This, according to the Central Bank, would ensure sanity in the micro-finance sector to encourage only legal ones that are paying realistic interest rates to operate.

Raymond Amanfu, Head of Other Financial Institutions Supervision Department, BoG, who made this known at a press briefing in Accra last Friday, said some micro-finance institutions have voluntarily closed and/or were facing severe liquidity challenges.

In view of that, he said the Central Bank would soon take action on these institutions and shall close any illegal institutions that take deposits.

Mr. Amanfo expressed worry about the proliferation of unlicensed micro-finance companies and fun clubs that promise high and unsustainable interest rates to customers.

These institutions, he said, were mushrooming in rural areas, especially Brong-Ahafo, Upper West, Northern and Western Regions.

Mr. Amanfo said the Central Bank has identified about 10 unlicensed micro-finance institutions.

These institutions, he mentioned, are Care for Humanity International, Buoyant Investment Limited, God Is Love Fun Club, Perfect Edge Group, Perfect Business Fun Club, L.P.M Eye Adom Fun Club, Creative Fun Club, Little Drops Helping Hand Association, Financial Giants Fun Club and Great Winners Fun Club.

Mr. Amanfo told the general public that the Central Bank would not be responsible for the liabilities of these unlicensed institutions, stating “the public is therefore cautioned to desist from doing business with such unlicensed institutions.”

He accused the media houses of encouraging illegal activities of these unlicensed micro-finance institutions through advertisements.

Mr. Amanfo said the bank is collaborating with Financial Intelligence Center and security agencies to track down, arrest and prosecute directors, shareholders and management of unlicensed institutions.

“We may have to include media houses that advertise these illegal institutions such as Fun Clubs and Associations for abetment of crime,” he added.

Currently, there are 518 micro-finance institutions, comprising 447 micro-finance companies, 63 Money Lending Companies and eight Financial NGOs, while another 117 institutions are yet to fulfill the final approval requirement.

Business News of Monday, 24 August 2015

Source: Daily Guide

50 Micro-Finance Companies licenses to be revoked

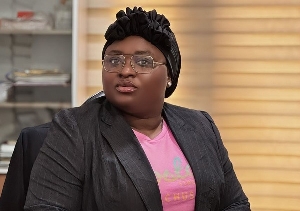

Dr Henry Kofi Wampah - BoG Governor

Dr Henry Kofi Wampah - BoG Governor

News

Abundant evidence confirms lithovit's effectiveness: AG justifies withdrawal of Opuni-Agongo case

Sports